Sia

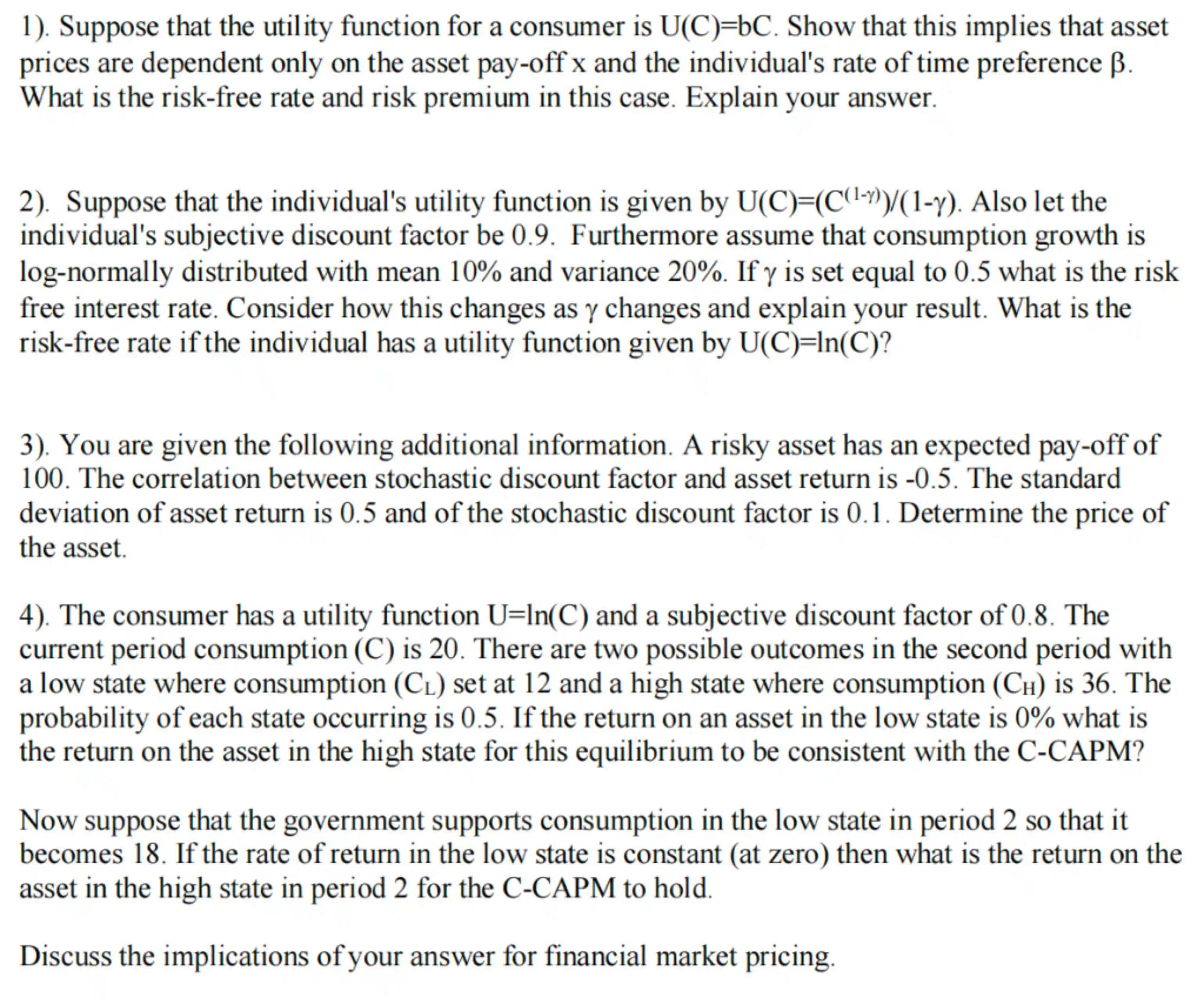

1). Suppose that the utility function for a consumer is . Show that this implies that asset prices are dependent only on the asset pay-off and the individual's rate of time preference . What is the risk-free rate and risk premium in this case. Explain your answer.

2). Suppose that the individual's utility function is given by . Also let the individual's subjective discount factor be 0.9 . Furthermore assume that consumption growth is log-normally distributed with mean and variance . If is set equal to 0.5 what is the risk free interest rate. Consider how this changes as changes and explain your result. What is the risk-free rate if the individual has a utility function given by ?

3). You are given the following additional information. A risky asset has an expected pay-off of 100. The correlation between stochastic discount factor and asset return is -0.5 . The standard deviation of asset return is 0.5 and of the stochastic discount factor is 0.1 . Determine the price of the asset.

4). The consumer has a utility function and a subjective discount factor of 0.8 . The current period consumption is 20 . There are two possible outcomes in the second period with a low state where consumption set at 12 and a high state where consumption is 36 . The probability of each state occurring is 0.5 . If the return on an asset in the low state is what is the return on the asset in the high state for this equilibrium to be consistent with the C-CAPM?

Now suppose that the government supports consumption in the low state in period 2 so that it becomes 18. If the rate of return in the low state is constant (at zero) then what is the return on the asset in the high state in period 2 for the C-CAPM to hold.

Discuss the implications of your answer for financial market pricing.

Answer from Sia

Posted almost 2 years ago

1 Solution

a

Utility Function and Asset Prices: The utility function implies linear utility, which means the consumer is risk-neutral

b

Asset Pricing: In a risk-neutral world, the asset price today equals the expected payoff discounted by the rate of time preference,

c

Risk-Free Rate and Risk Premium: The risk-free rate is the rate of time preference , and the risk premium is zero since the consumer is indifferent to risk

1 Answer

The asset prices depend only on the payoff and the rate of time preference . The risk-free rate is , and the risk premium is zero.

Key Concept

Asset pricing in a risk-neutral world

Explanation

In a risk-neutral world, consumers value future payoffs by simply discounting them at their rate of time preference, without any additional risk premium.

2 Solution

a

CRRA Utility Function: The utility function represents a constant relative risk aversion (CRRA) utility function

b

Risk-Free Rate with : Using the Euler equation for consumption, the risk-free rate can be found by solving . With , the risk-free rate is determined by the consumption growth rate

c

Risk-Free Rate as Changes: As changes, the risk-free rate will change reflecting the consumer's changing attitude towards risk

d

Risk-Free Rate with Log Utility: When , the utility function becomes , and the risk-free rate can be found using the same Euler equation

2 Answer

The risk-free rate with depends on the consumption growth rate. As changes, the risk-free rate changes, reflecting different levels of risk aversion. With log utility, the risk-free rate is determined by the Euler equation with .

Key Concept

Risk-free rate determination under CRRA utility

Explanation

The risk-free rate is influenced by the consumer's relative risk aversion and the expected consumption growth rate. Higher risk aversion leads to a higher risk-free rate.

3 Solution

a

Asset Pricing with Stochastic Discount Factor: The price of an asset is the present value of its expected payoff, discounted by the stochastic discount factor (SDF),

b

Calculating Asset Price: Given the expected payoff, correlation, and standard deviations, the price is found by , where is the SDF

3 Answer

The price of the asset is determined by the expected payoff, the correlation between the SDF and asset return, and their standard deviations.

Key Concept

Asset pricing using the stochastic discount factor

Explanation

The price of a risky asset is calculated by discounting its expected payoff by the stochastic discount factor, which incorporates the time value of money and risk.

4 Solution

a

C-CAPM and Asset Returns: The Consumption Capital Asset Pricing Model (C-CAPM) relates the return on an asset to the consumption growth in different states

b

Return in High State: Using the C-CAPM, the return in the high state is found by solving

c

Adjusted Return with Government Support: With government support, the return in the high state is found by solving

4 Answer

The return on the asset in the high state for the equilibrium to be consistent with the C-CAPM is found by solving the respective equations for and with and without government support.

Key Concept

C-CAPM equilibrium asset returns

Explanation

The C-CAPM framework is used to determine the required return on an asset in different states of the world, ensuring that the expected utility from consumption is maximized.

Not the question you are looking for? Ask here!

Enter question by text

Enter question by image

Unlock Smarter Learning with AskSia Super!

Join Super, our all-in-one AI solution that can greatly improve your learning efficiency.

30% higher accuracy than GPT-4o

Entire learning journey support

The most student-friendly features

Study Other Question