Sia

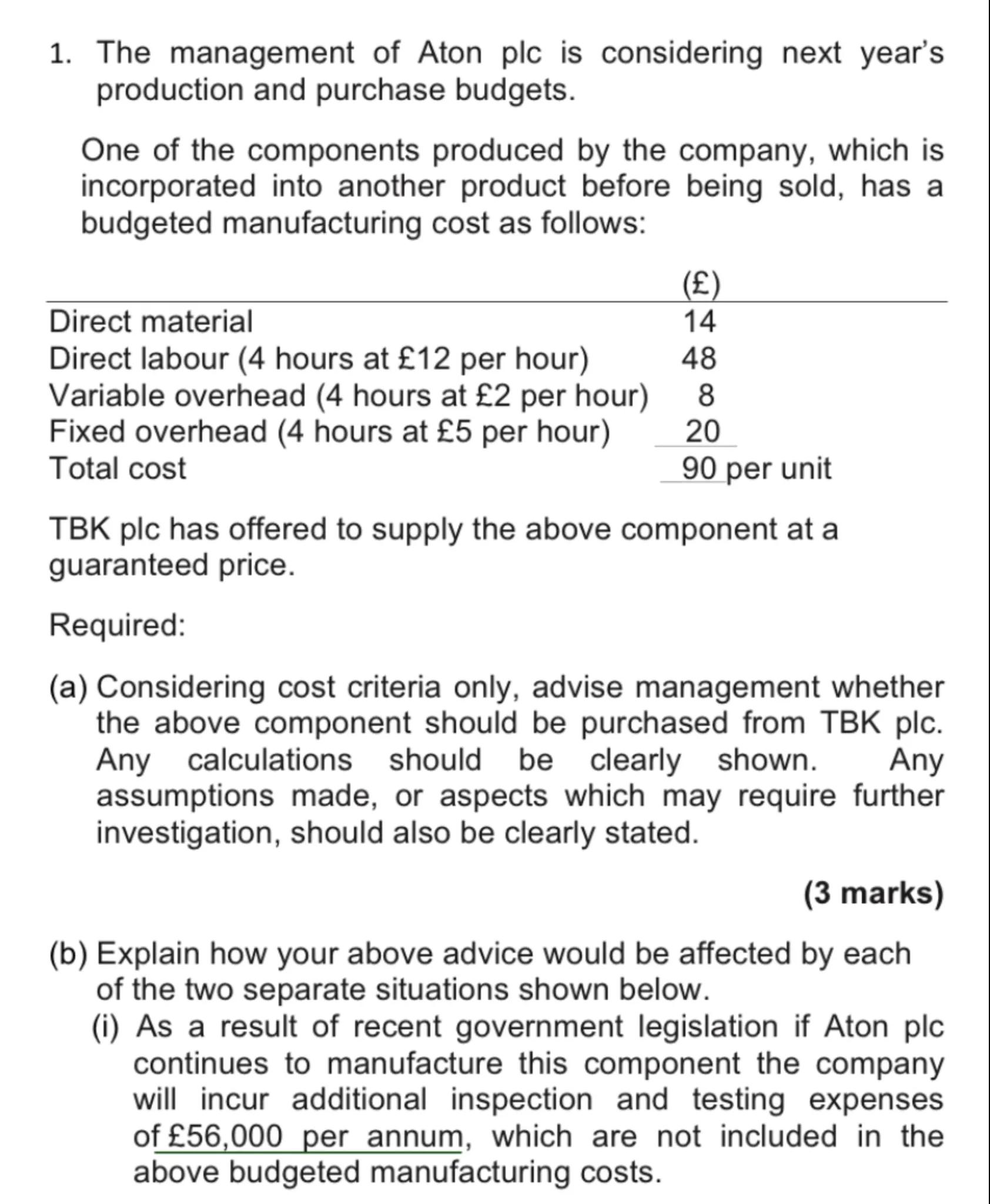

1. The management of Aton plc is considering next year's production and purchase budgets.

One of the components produced by the company, which is incorporated into another product before being sold, has a budgeted manufacturing cost as follows:

\begin{tabular}{lc}

& \\

\hline Direct material & 14 \\

Direct labour (4 hours at per hour) & 48 \\

Variable overhead (4 hours at per hour) & 8 \\

Fixed overhead (4 hours at per hour) & 20 \\

Total cost & 90 per unit

\end{tabular}

TBK plc has offered to supply the above component at a guaranteed price.

Required:

(a) Considering cost criteria only, advise management whether the above component should be purchased from TBK plc. Any calculations should be clearly shown. Any assumptions made, or aspects which may require further investigation, should also be clearly stated.

(3 marks)

(b) Explain how your above advice would be affected by each of the two separate situations shown below.

(i) As a result of recent government legislation if Aton plc continues to manufacture this component the company will incur additional inspection and testing expenses of per annum, which are not included in the above budgeted manufacturing costs.

Answer from Sia

Posted over 1 year ago

Solution by Steps

step 1

Calculate the total budgeted manufacturing cost per unit for the component produced by Aton plc

step 2

The total cost is given by the sum of direct material, direct labour, variable overhead, and fixed overhead

step 3

Total cost per unit = £14 (Direct material) + £48 (Direct labour) + £8 (Variable overhead) + £20 (Fixed overhead) = £90

step 4

Compare the total budgeted manufacturing cost per unit with the guaranteed price offered by TBK plc

step 5

If the guaranteed price offered by TBK plc is less than £90, then it is cost-effective to purchase the component from TBK plc. Otherwise, it is more cost-effective to produce the component in-house

Answer

The management should compare the guaranteed price offered by TBK plc with the total budgeted manufacturing cost of £90 per unit. If the price offered by TBK plc is less than £90, they should purchase the component from TBK plc. Otherwise, they should continue to produce the component in-house.

Key Concept

Cost comparison

Explanation

The decision to purchase or produce the component should be based on a comparison of the total budgeted manufacturing cost per unit with the guaranteed price offered by TBK plc.

Solution by Steps

step 1

Calculate the additional inspection and testing expenses incurred due to recent government legislation

step 2

The additional expenses are £56,000 per annum

step 3

Determine the impact of these additional expenses on the cost per unit

step 4

If Aton plc produces 10,000 units per year, the additional cost per unit is £56,000 / 10,000 units = £5.60 per unit

step 5

Add the additional cost per unit to the total budgeted manufacturing cost per unit

step 6

New total cost per unit = £90 + £5.60 = £95.60

step 7

Compare the new total cost per unit with the guaranteed price offered by TBK plc

step 8

If the guaranteed price offered by TBK plc is less than £95.60, then it is cost-effective to purchase the component from TBK plc. Otherwise, it is more cost-effective to produce the component in-house

Answer

Considering the additional inspection and testing expenses, the new total cost per unit is £95.60. The management should compare this new cost with the guaranteed price offered by TBK plc. If the price offered by TBK plc is less than £95.60, they should purchase the component from TBK plc. Otherwise, they should continue to produce the component in-house.

Key Concept

Impact of additional expenses

Explanation

The additional inspection and testing expenses increase the total cost per unit, which should be considered when comparing with the guaranteed price offered by TBK plc.

Not the question you are looking for? Ask here!

Enter question by text

Enter question by image

Unlock Smarter Learning with AskSia Super!

Join Super, our all-in-one AI solution that can greatly improve your learning efficiency.

30% higher accuracy than GPT-4o

Entire learning journey support

The most student-friendly features

Study Other Question