Sia

20:32

:!!

41

Assignment 1 Questions.pdf

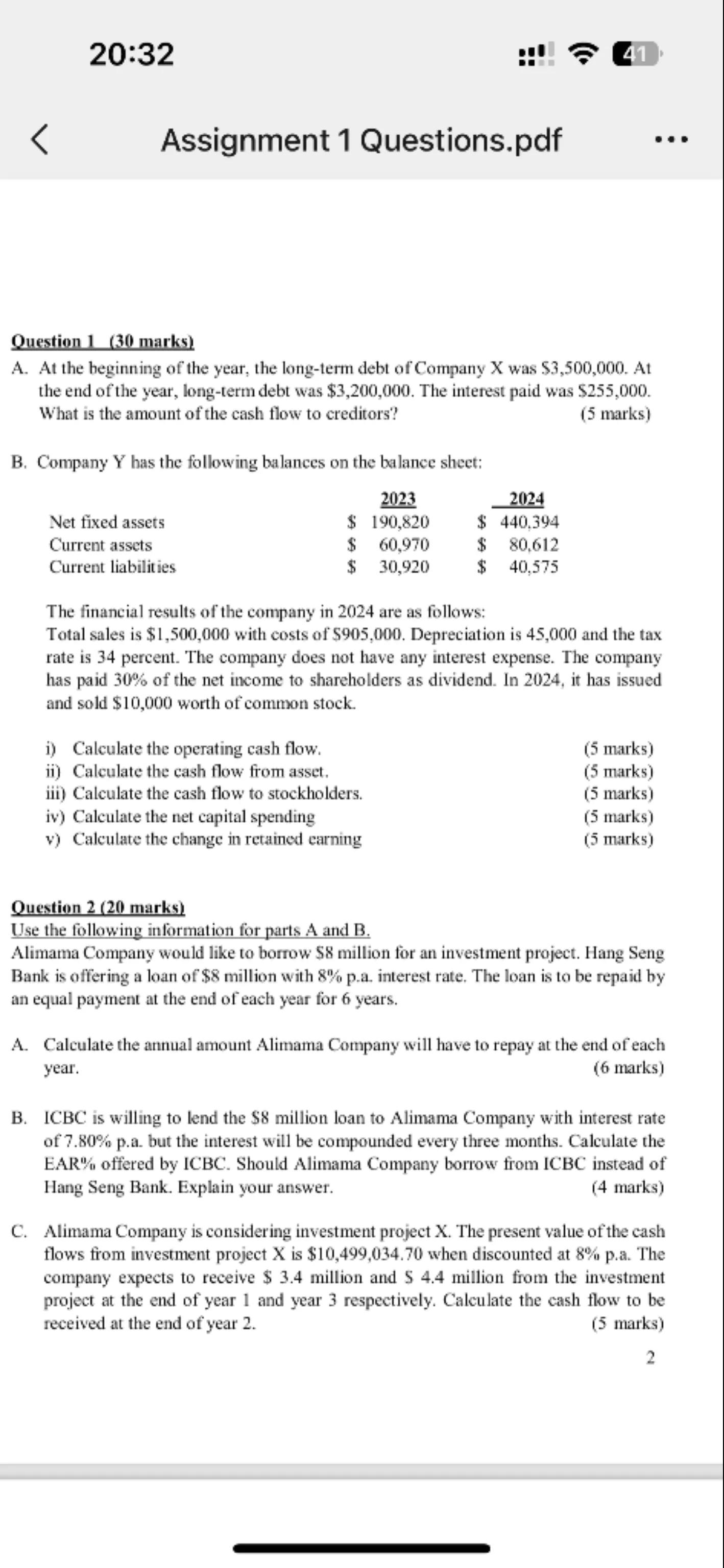

Question 1 ( 30 marks)

A. At the beginning of the year, the long-term debt of Company X was . At the end of the year, long-term debt was . The interest paid was . What is the amount of the cash flow to creditors?

(5 marks)

B. Company Y has the following balances on the balance sheet:

Net fixed assets

Current assets

Current liabilities

\begin{tabular}{|c|c|c|c|}

\hline & 2023 & & 2024 \\

\hline \ & 190,820 & \$ & 440,394 \\

\hline \$ & 60,970 & \$ & 80,612 \\

\hline \$ & 30,920 & \$ & 40,575 \\

\hline

\end{tabular}

The financial results of the company in 2024 are as follows:

Total sales is \ with costs of . Depreciation is 45,000 and the tax rate is 34 percent. The company does not have any interest expense. The company has paid of the net income to shareholders as dividend. In 2024, it has issued and sold worth of common stock.

i) Calculate the operating cash flow.

ii) Calculate the cash flow from asset.

iii) Calculate the cash flow to stockholders.

iv) Calculate the net capital spending

v) Calculate the change in retained carning

(5 marks)

(5 marks)

(5 marks)

(5 marks)

(5 marks)

Question marks)

Use the following information for parts and .

Alimama Company would like to borrow million for an investment project. Hang Seng Bank is offering a loan of million with p.a. interest rate. The loan is to be repaid by an equal payment at the end of each year for 6 years.

A. Calculate the annual amount Alimama Company will have to repay at the end of each year.

( 6 marks)

B. ICBC is willing to lend the million loan to Alimama Company with interest rate of p.a. but the interest will be compounded every three months. Calculate the EAR\% offered by ICBC. Should Alimama Company borrow from ICBC instead of Hang Seng Bank. Explain your answer.

(4 marks)

C. Alimama Company is considering investment project X . The present value of the cash flows from investment project is when discounted at p.a. The company expects to receive million and million from the investment project at the end of year 1 and year 3 respectively. Calculate the cash flow to be received at the end of year 2 .

(5 marks)

2

Answer from Sia

Posted over 1 year ago

Hi Anna! It looks like you have some finance-related questions from your assignment. Let's break them down one by one.

Question 1

A. Cash Flow to Creditors:

To calculate the cash flow to creditors, you can use the formula:

Where:

- Net New Borrowing = Long-term Debt at End of Year - Long-term Debt at Beginning of Year

Given:

- Long-term Debt at Beginning = 3,200,000

- Interest Paid = $255,000

First, calculate the Net New Borrowing:

\[ \text{Net New Borrowing} = 3,200,000 - 3,500,000 = -300,000 \]

Now plug this into the cash flow formula:

\[ \text{Cash Flow to Creditors} = 255,000 - (-300,000) = 255,000 + 300,000 = 555,000 \]

B. Company Y Calculations:

1. Operating Cash Flow (OCF):

First, calculate Net Income:

Taxes = (Total Sales - Costs - Depreciation) * Tax Rate

After calculating Net Income, add Depreciation to find OCF.

2. Cash Flow from Assets:

3. Cash Flow to Stockholders:

4. Net Capital Spending:

5. Change in Retained Earnings:

Question 2

A. Annual Repayment Amount:

You can use the formula for an annuity to find the annual payment:

Where:

- = annual payment

- = interest rate per period

- = present value (loan amount)

- = number of periods

B. Effective Annual Rate (EAR):

To calculate EAR for ICBC:

Where is the number of compounding periods per year.

C. Cash Flow at End of Year 2:

You can use the present value formula to find the cash flow at the end of year 2:

Rearranging this will help you find the cash flow for year 2.

If you need help with any specific calculations or concepts, feel free to ask!Not the question you are looking for? Ask here!

Enter question by text

Enter question by image

Unlock Smarter Learning with AskSia Super!

Join Super, our all-in-one AI solution that can greatly improve your learning efficiency.

30% higher accuracy than GPT-4o

Entire learning journey support

The most student-friendly features

Study Other Question