Sia

Question

Microeconomics

Posted almost 2 years ago

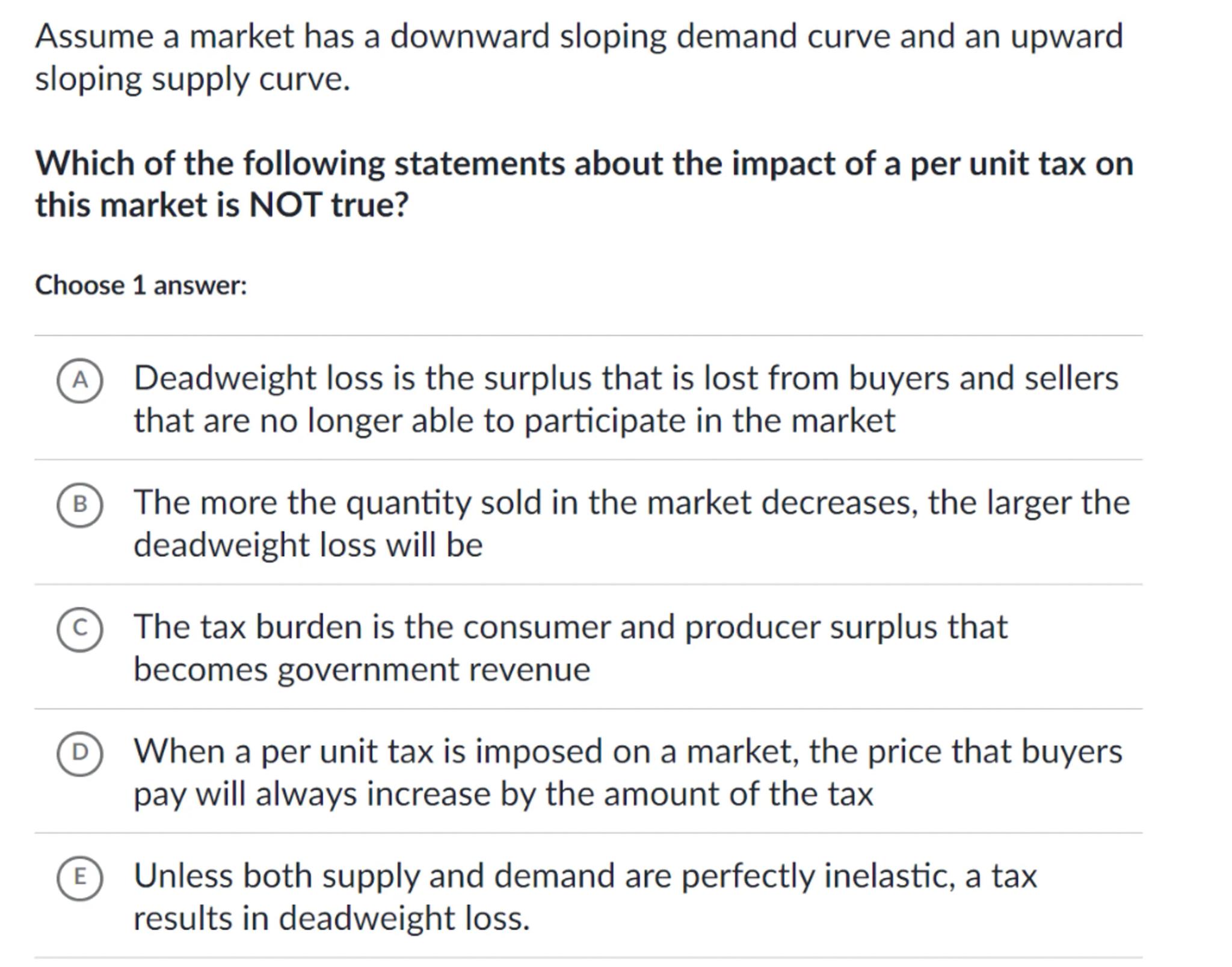

Assume a market has a downward sloping demand curve and an upward sloping supply curve.

Which of the following statements about the impact of a per unit tax on this market is NOT true?

Choose 1 answer:

(A) Deadweight loss is the surplus that is lost from buyers and sellers that are no longer able to participate in the market

(B) The more the quantity sold in the market decreases, the larger the deadweight loss will be

C The tax burden is the consumer and producer surplus that becomes government revenue

(D) When a per unit tax is imposed on a market, the price that buyers pay will always increase by the amount of the tax

(E) Unless both supply and demand are perfectly inelastic, a tax results in deadweight loss.

Answer from Sia

Posted almost 2 years ago

Solution

a

Deadweight Loss: Deadweight loss is the surplus lost from buyers and sellers who are no longer able to participate in the market due to the tax

b

Quantity Decrease: The more the quantity sold in the market decreases, the larger the deadweight loss will be

c

Tax Burden: The tax burden is not the consumer and producer surplus that becomes government revenue. Instead, it is the division of the tax payment between consumers and producers

d

Price Increase: When a per unit tax is imposed on a market, the price that buyers pay does not always increase by the amount of the tax. The actual increase depends on the elasticities of supply and demand

e

Deadweight Loss Condition: Unless both supply and demand are perfectly inelastic, a tax results in deadweight loss

Answer

(D) When a per unit tax is imposed on a market, the price that buyers pay will always increase by the amount of the tax

Key Concept

Price Increase and Elasticity

Explanation

The price that buyers pay does not always increase by the full amount of the tax because the actual price change depends on the relative elasticities of supply and demand. If either supply or demand is elastic, the price increase will be less than the full amount of the tax.

Not the question you are looking for? Ask here!

Enter question by text

Enter question by image

Unlock Smarter Learning with AskSia Super!

Join Super, our all-in-one AI solution that can greatly improve your learning efficiency.

30% higher accuracy than GPT-4o

Entire learning journey support

The most student-friendly features

Study Other Question