Sia

Question

Statistics

Posted almost 2 years ago

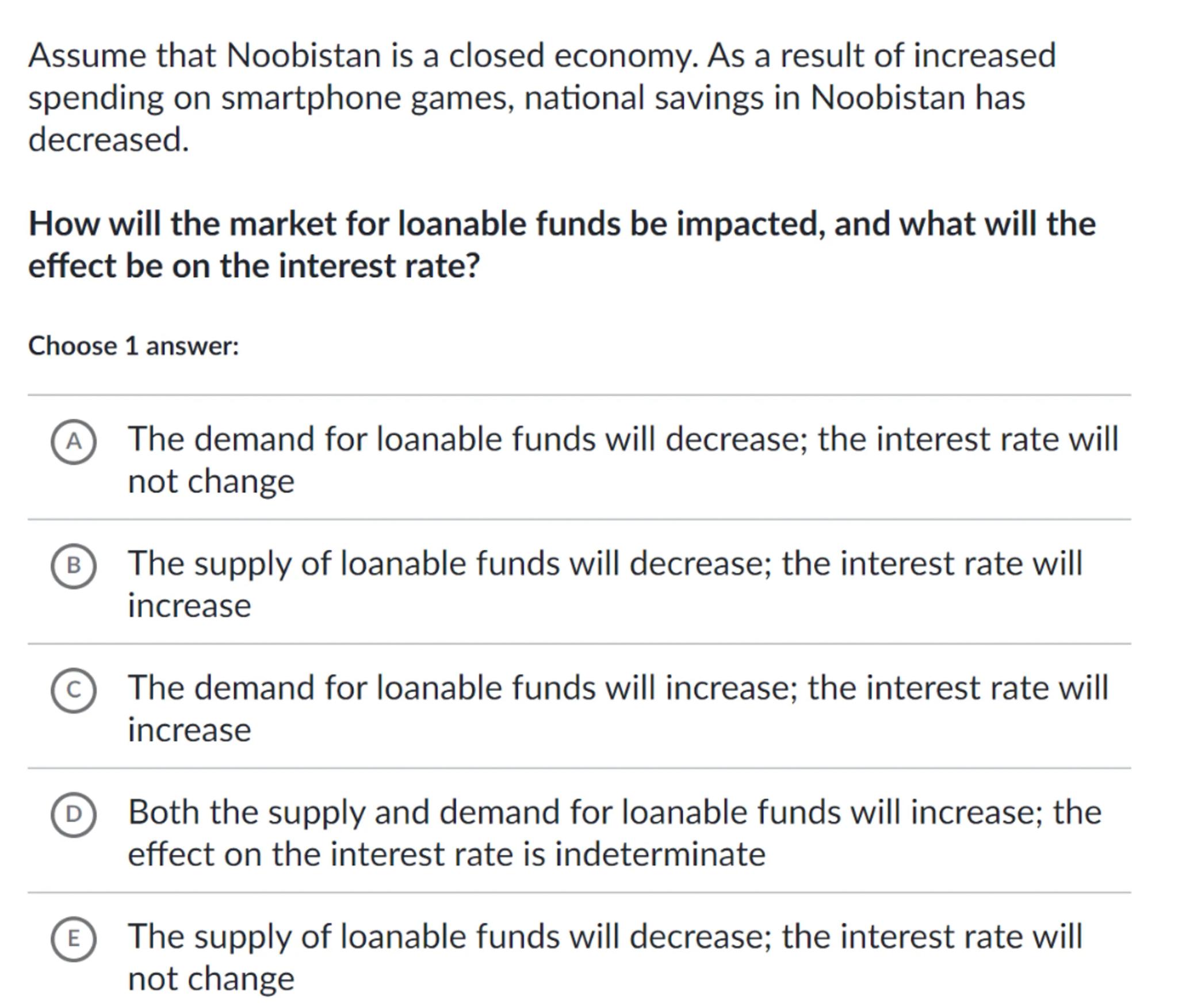

Assume that Noobistan is a closed economy. As a result of increased spending on smartphone games, national savings in Noobistan has decreased.

How will the market for loanable funds be impacted, and what will the effect be on the interest rate?

Choose 1 answer:

A. The demand for loanable funds will decrease; the interest rate will not change

B The supply of loanable funds will decrease; the interest rate will increase

(c) The demand for loanable funds will increase; the interest rate will increase

(D) Both the supply and demand for loanable funds will increase; the effect on the interest rate is indeterminate

(E) The supply of loanable funds will decrease; the interest rate will not change

Answer from Sia

Posted almost 2 years ago

Solution by Steps

step 1

In a closed economy, the market for loanable funds is determined by the supply and demand for loanable funds

step 2

National savings represent the supply of loanable funds. A decrease in national savings means a decrease in the supply of loanable funds

step 3

According to the law of supply and demand, a decrease in the supply of loanable funds, with demand remaining constant, will lead to an increase in the interest rate

Answer

B

Key Concept

Supply and demand in the loanable funds market

Explanation

A decrease in national savings reduces the supply of loanable funds, leading to higher interest rates if demand remains unchanged.

Not the question you are looking for? Ask here!

Enter question by text

Enter question by image

Unlock Smarter Learning with AskSia Super!

Join Super, our all-in-one AI solution that can greatly improve your learning efficiency.

30% higher accuracy than GPT-4o

Entire learning journey support

The most student-friendly features

Study Other Question