Sia

Question

Microeconomics

Posted over 1 year ago

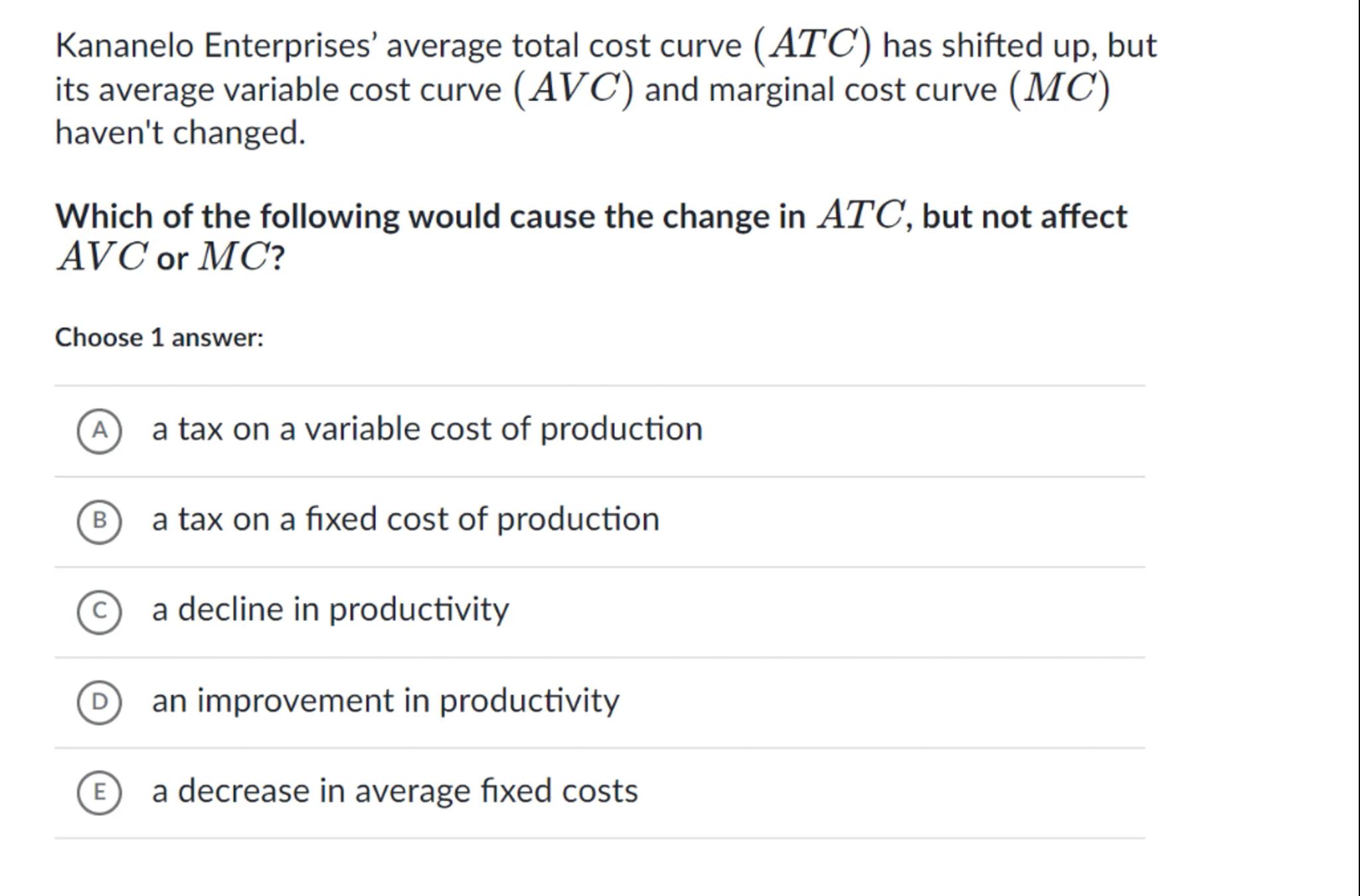

Kananelo Enterprises' average total cost curve has shifted up, but its average variable cost curve and marginal cost curve haven't changed.

Which of the following would cause the change in , but not affect or

Choose 1 answer:

(A) a tax on a variable cost of production

(B) a tax on a fixed cost of production

(c) a decline in productivity

(D) an improvement in productivity

(E) a decrease in average fixed costs

Answer from Sia

Posted over 1 year ago

Solution

a

Analysis of Cost Curves: The average total cost (ATC) curve includes both fixed and variable costs, while the average variable cost (AVC) and marginal cost (MC) curves only include variable costs

b

Impact of Fixed Costs: A tax on a fixed cost of production would increase the ATC but not affect the AVC or MC, as these curves are only influenced by variable costs

Answer

(B) a tax on a fixed cost of production

Key Concept

Fixed Costs and Cost Curves

Explanation

A tax on a fixed cost of production increases the average total cost (ATC) because fixed costs are part of the total costs. However, it does not affect the average variable cost (AVC) or marginal cost (MC) since these are only influenced by variable costs.

Not the question you are looking for? Ask here!

Enter question by text

Enter question by image

Unlock Smarter Learning with AskSia Super!

Join Super, our all-in-one AI solution that can greatly improve your learning efficiency.

30% higher accuracy than GPT-4o

Entire learning journey support

The most student-friendly features

Study Other Question