Sia

Question

Statistics

Posted almost 2 years ago

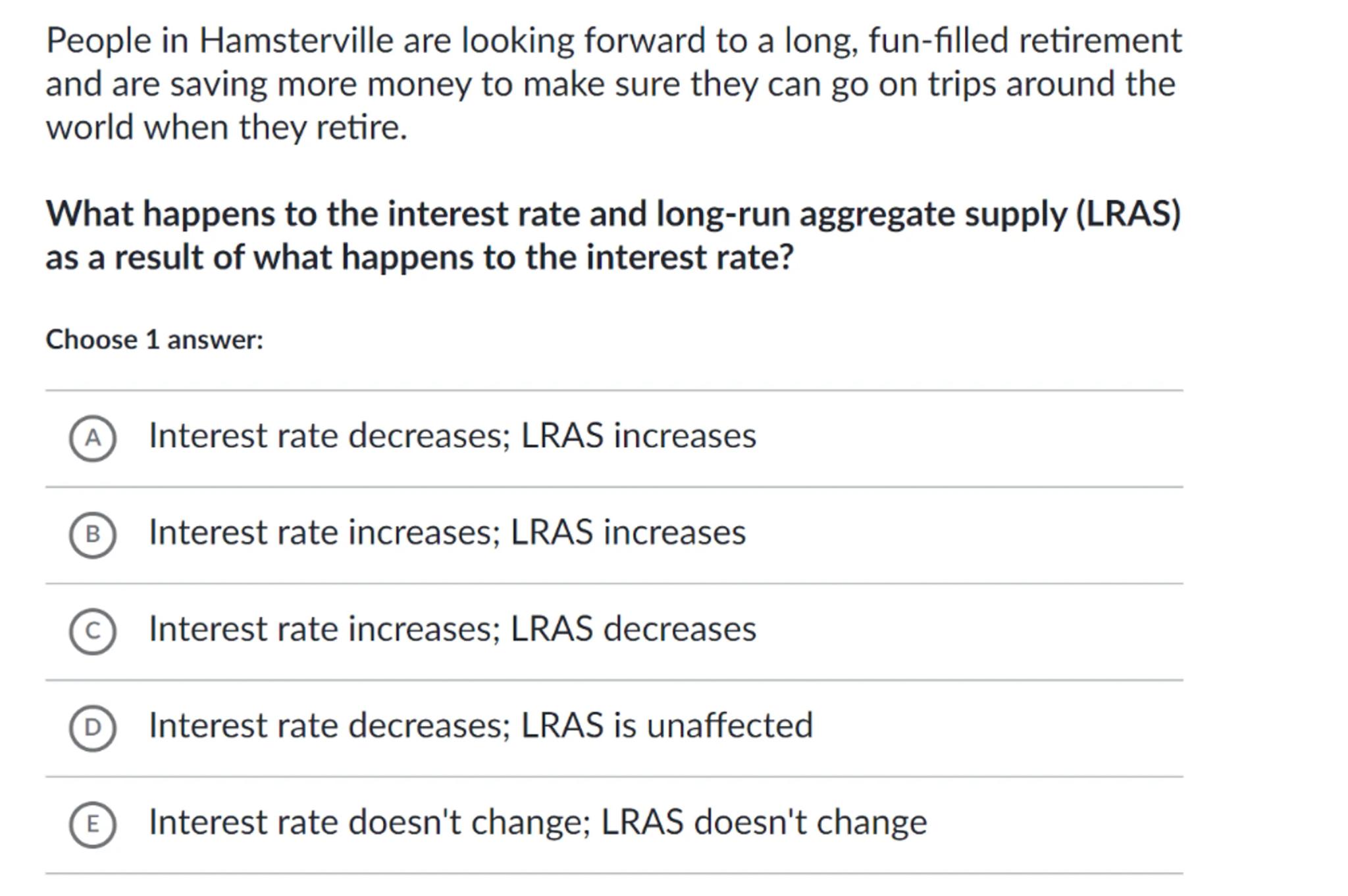

People in Hamsterville are looking forward to a long, fun-filled retirement and are saving more money to make sure they can go on trips around the world when they retire.

What happens to the interest rate and long-run aggregate supply (LRAS) as a result of what happens to the interest rate?

Choose 1 answer:

(A) Interest rate decreases; LRAS increases

(B) Interest rate increases; LRAS increases

(c) Interest rate increases; LRAS decreases

(D) Interest rate decreases; LRAS is unaffected

(E) Interest rate doesn't change; LRAS doesn't change

Answer from Sia

Posted almost 2 years ago

Solution by Steps

step 1

To understand the impact of increased savings on the interest rate, we consider the supply and demand model for loanable funds. An increase in savings shifts the supply curve for loanable funds to the right

step 2

According to the law of demand, an increase in the supply of loanable funds, with demand remaining constant, leads to a decrease in the equilibrium interest rate

step 3

A decrease in the interest rate reduces the cost of borrowing, which can encourage investment and potentially increase the long-run aggregate supply (LRAS) as the economy's productive capacity expands

Answer

A

Key Concept

Loanable Funds Market and LRAS

Explanation

Increased savings lead to a higher supply of loanable funds, which decreases the interest rate and can increase the long-run aggregate supply as investment becomes more attractive.

Not the question you are looking for? Ask here!

Enter question by text

Enter question by image

Unlock Smarter Learning with AskSia Super!

Join Super, our all-in-one AI solution that can greatly improve your learning efficiency.

30% higher accuracy than GPT-4o

Entire learning journey support

The most student-friendly features

Study Other Question