Sia

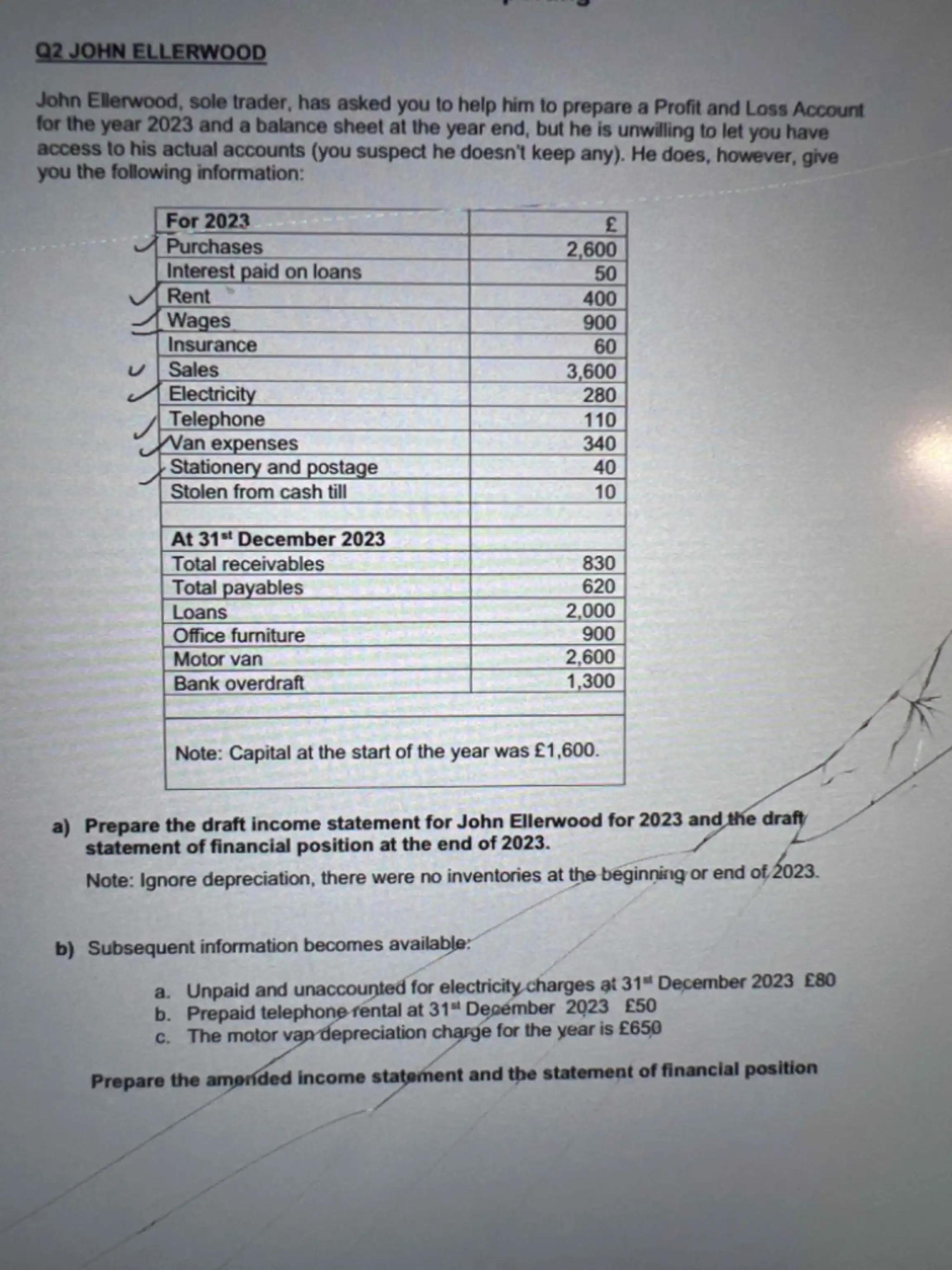

Q2 JOHN ELLERWOOD

John Ellerwood, sole trader, has asked you to help him to prepare a Profit and Loss Account for the year 2023 and a balance sheet at the year end, but he is unwilling to let you have access to his actual accounts (you suspect he doesn't keep any). He does, however, give you the following information:

\begin{tabular}{|l|r|}

\hline For 2023 & \\

\hline Purchases & 2,600 \\

\hline Interest paid on loans & 50 \\

\hline Rent & 400 \\

\hline Wages & 900 \\

\hline Insurance & 60 \\

\hline Sales & 3,600 \\

\hline Electricity & 280 \\

\hline Telephone & 110 \\

\hline Nan expenses & 340 \\

\hline Stationery and postage & 40 \\

\hline Stolen from cash till & 10 \\

\hline & \\

\hline At 31st December 2023 & 830 \\

\hline Total receivables & 620 \\

\hline Total payables & 2,000 \\

\hline Loans & 900 \\

\hline Office furniture & 2,600 \\

\hline Motor van & 1,300 \\

\hline Bank overdraft & \\

\hline & \\

\hline Note: Capital at the start of the year was . \\

\hline

\end{tabular}

a) Prepare the draft income statement for John Ellerwood for 2023 and the draft statement of financial position at the end of 2023.

Note: Ignore depreciation, there were no inventories at the beginning or end of 2023.

b) Subsequent information becomes available:

a. Unpaid and unaccounted for electricity charges at December 2023 £80

b. Prepaid telephone rental at Degember 2023 E50

c. The motor vandepreciation charge for the year is

Prepare the amonded income statement and the statement of financial position

Answer from Sia

Posted over 1 year ago

To prepare the draft income statement and the statement of financial position for John Ellerwood for the year 2023, let's start with the income statement.

Draft Income Statement for John Ellerwood for 2023

Sales:

- Sales Revenue: £3,600

Less: Cost of Goods Sold (COGS):

- Purchases: £2,600

Gross Profit:

- Gross Profit = Sales - COGS = £3,600 - £2,600 = £1,000

Less: Operating Expenses:

- Interest Paid: £50

- Rent: £400

- Wages: £900

- Insurance: £60

- Electricity: £280

- Telephone: £110

- Other Expenses: £340

- Stationery and Postage: £40

- Stolen from Cash Till: £10

Total Operating Expenses:

- Total = £50 + £400 + £900 + £60 + £280 + £110 + £340 + £40 + £10 = £1,800

Net Profit (Loss):

- Net Profit = Gross Profit - Total Operating Expenses = £1,000 - £1,800 = -£800 (Net Loss)

Draft Statement of Financial Position as at 31 December 2023

Assets:

- Total Receivables: £620

- Cash (assumed to be the remaining balance after expenses): £830

- Office Furniture: £2,600

- Motor Van: £1,300

Total Assets:

- Total Assets = £620 + £830 + £2,600 + £1,300 = £5,350

Liabilities:

- Total Payables: £2,000

- Loans: £900

- Bank Overdraft: (not provided, but we can assume it is included in payables)

Total Liabilities:

- Total Liabilities = £2,000 + £900 = £2,900

Equity:

- Capital at the start of the year: £1,600

- Net Loss: -£800

Total Equity:

- Total Equity = £1,600 - £800 = £800

Final Statement of Financial Position

Total Assets: £5,350

Total Liabilities: £2,900

Total Equity: £800

Amendments Based on Subsequent Information

1. Unpaid Electricity Charges:

- Add £80 to liabilities (Total Payables = £2,000 + £80 = £2,080)

2. Prepaid Telephone Rental:

- Subtract £50 from assets (Total Receivables = £620 - £50 = £570)

3. Motor Van Depreciation:

- Subtract £650 from equity (Total Equity = £800 - £650 = £150)

Amended Statement of Financial Position

Total Assets: £5,350 - £50 (prepaid) = £5,300

Total Liabilities: £2,080

Total Equity: £150

This gives you a comprehensive view of John Ellerwood's financial position at the end of 2023. If you have any further questions or need clarification on any part, feel free to ask!Not the question you are looking for? Ask here!

Enter question by text

Enter question by image

Unlock Smarter Learning with AskSia Super!

Join Super, our all-in-one AI solution that can greatly improve your learning efficiency.

30% higher accuracy than GPT-4o

Entire learning journey support

The most student-friendly features

Study Other Question