Sia

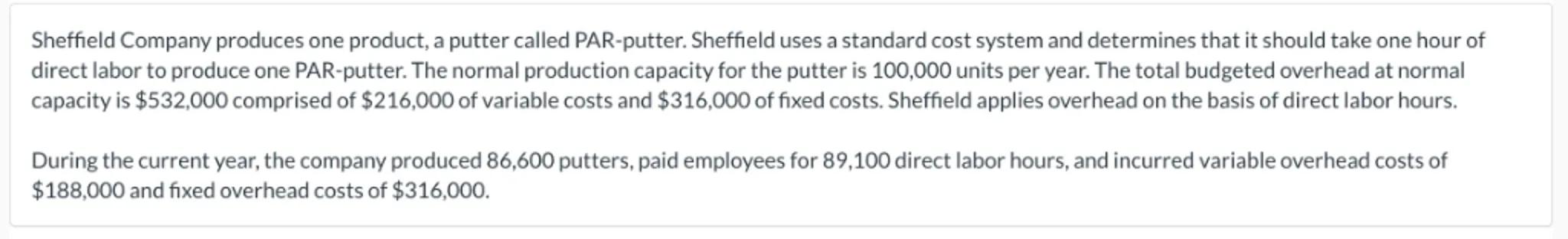

Sheffield Company produces one product, a putter called PAR-putter. Sheffield uses a standard cost system and determines that it should take one hour of direct labor to produce one PAR-putter. The normal production capacity for the putter is 100,000 units per year. The total budgeted overhead at normal capacity is comprised of of variable costs and of fixed costs. Sheffield applies overhead on the basis of direct labor hours.

During the current year, the company produced 86,600 putters, paid employees for 89,100 direct labor hours, and incurred variable overhead costs of and fixed overhead costs of .

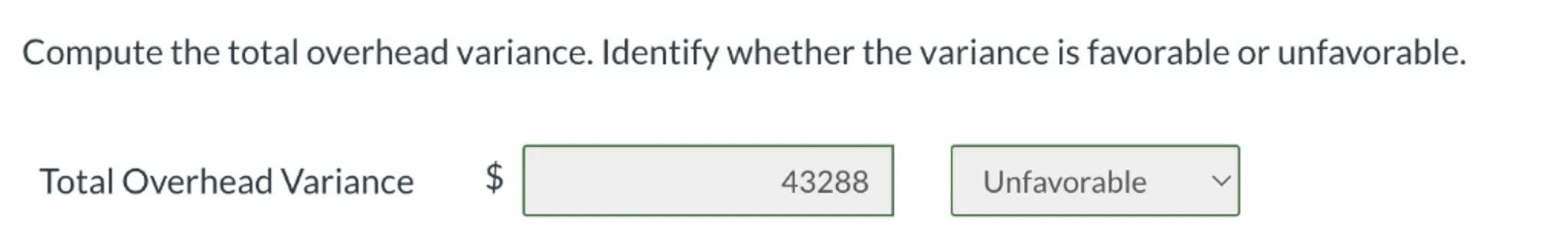

Compute the total overhead variance. Identify whether the variance is favorable or unfavorable.

Total Overhead Variance

Unfavorable

Answer from Sia

Posted over 1 year ago

Solution by Steps

step 1

Determine the predetermined variable overhead rate:

step 2

Determine the predetermined fixed overhead rate:

step 3

Calculate the total predetermined overhead rate:

step 4

Calculate the applied overhead:

step 5

Calculate the total actual overhead:

step 6

Calculate the total overhead variance:

Answer

Unfavorable

Key Concept

Total Overhead Variance

Explanation

The total overhead variance is the difference between the actual overhead incurred and the applied overhead. In this case, the variance is unfavorable because the actual overhead costs were higher than the applied overhead.

Not the question you are looking for? Ask here!

Enter question by text

Enter question by image

Unlock Smarter Learning with AskSia Super!

Join Super, our all-in-one AI solution that can greatly improve your learning efficiency.

30% higher accuracy than GPT-4o

Entire learning journey support

The most student-friendly features

Study Other Question