Sia

Question

Statistics

Posted almost 2 years ago

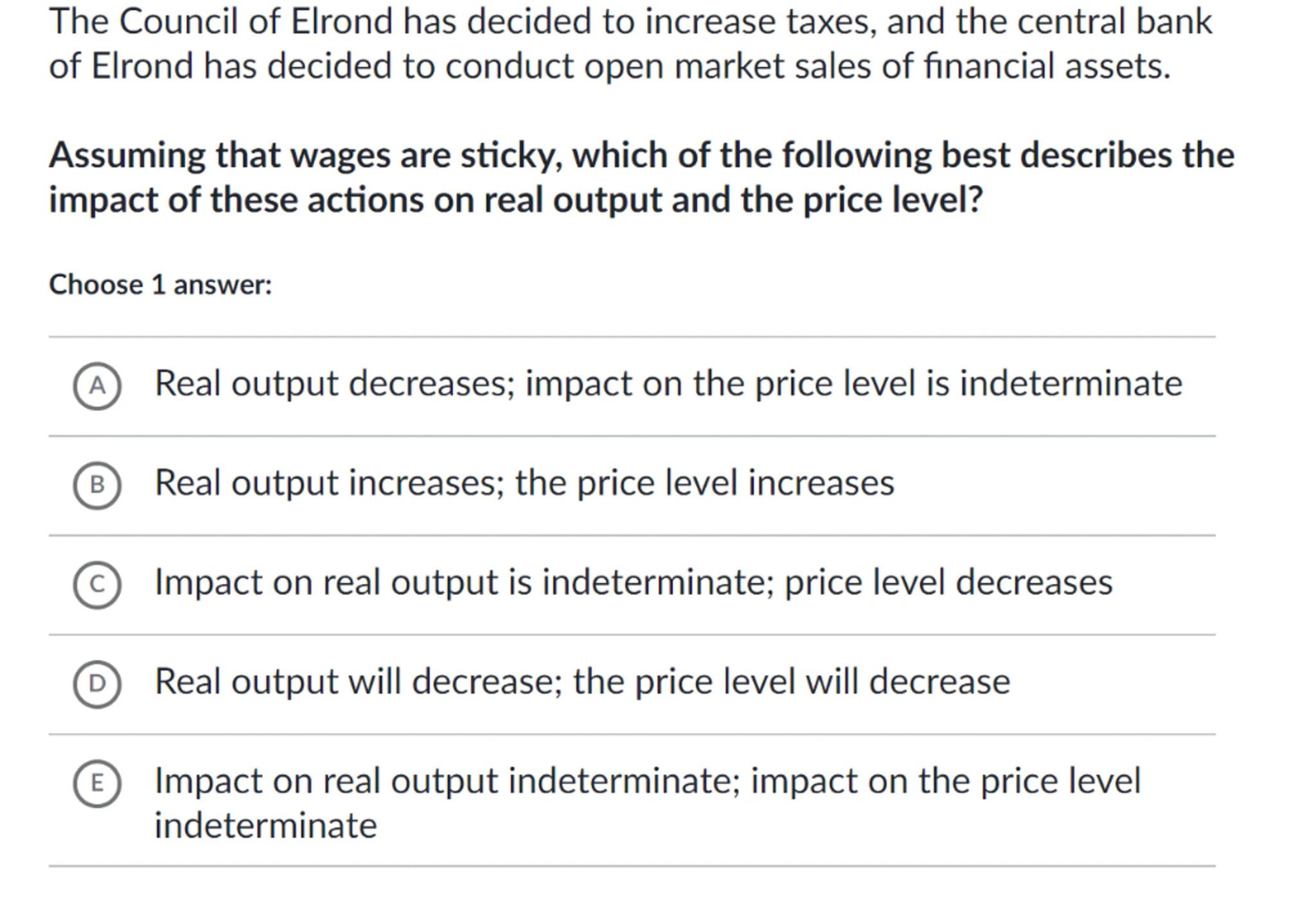

The Council of Elrond has decided to increase taxes, and the central bank of Elrond has decided to conduct open market sales of financial assets.

Assuming that wages are sticky, which of the following best describes the impact of these actions on real output and the price level?

Choose 1 answer:

(A) Real output decreases; impact on the price level is indeterminate

(B) Real output increases; the price level increases

(C) Impact on real output is indeterminate; price level decreases

(D) Real output will decrease; the price level will decrease

(E) Impact on real output indeterminate; impact on the price level indeterminate

Answer from Sia

Posted almost 2 years ago

Solution by Steps

step 1

To analyze the impact of the policy decisions on real output and the price level, we need to understand the effects of fiscal and monetary policy. Increasing taxes is a fiscal policy that tends to decrease aggregate demand

step 2

Conducting open market sales of financial assets is a monetary policy action that increases the interest rate, which also tends to decrease aggregate demand

step 3

With wages being sticky, the decrease in aggregate demand will not immediately result in lower wages, leading to a decrease in real output

step 4

The decrease in aggregate demand due to both fiscal contraction (tax increase) and monetary contraction (open market sales) will likely lead to a decrease in the price level as well

Answer

D

Key Concept

Fiscal and monetary contraction

Explanation

Increasing taxes and conducting open market sales both decrease aggregate demand, which leads to a decrease in real output and the price level when wages are sticky.

Not the question you are looking for? Ask here!

Enter question by text

Enter question by image

Unlock Smarter Learning with AskSia Super!

Join Super, our all-in-one AI solution that can greatly improve your learning efficiency.

30% higher accuracy than GPT-4o

Entire learning journey support

The most student-friendly features

Study Other Question