Sia

Question

Statistics

Posted almost 2 years ago

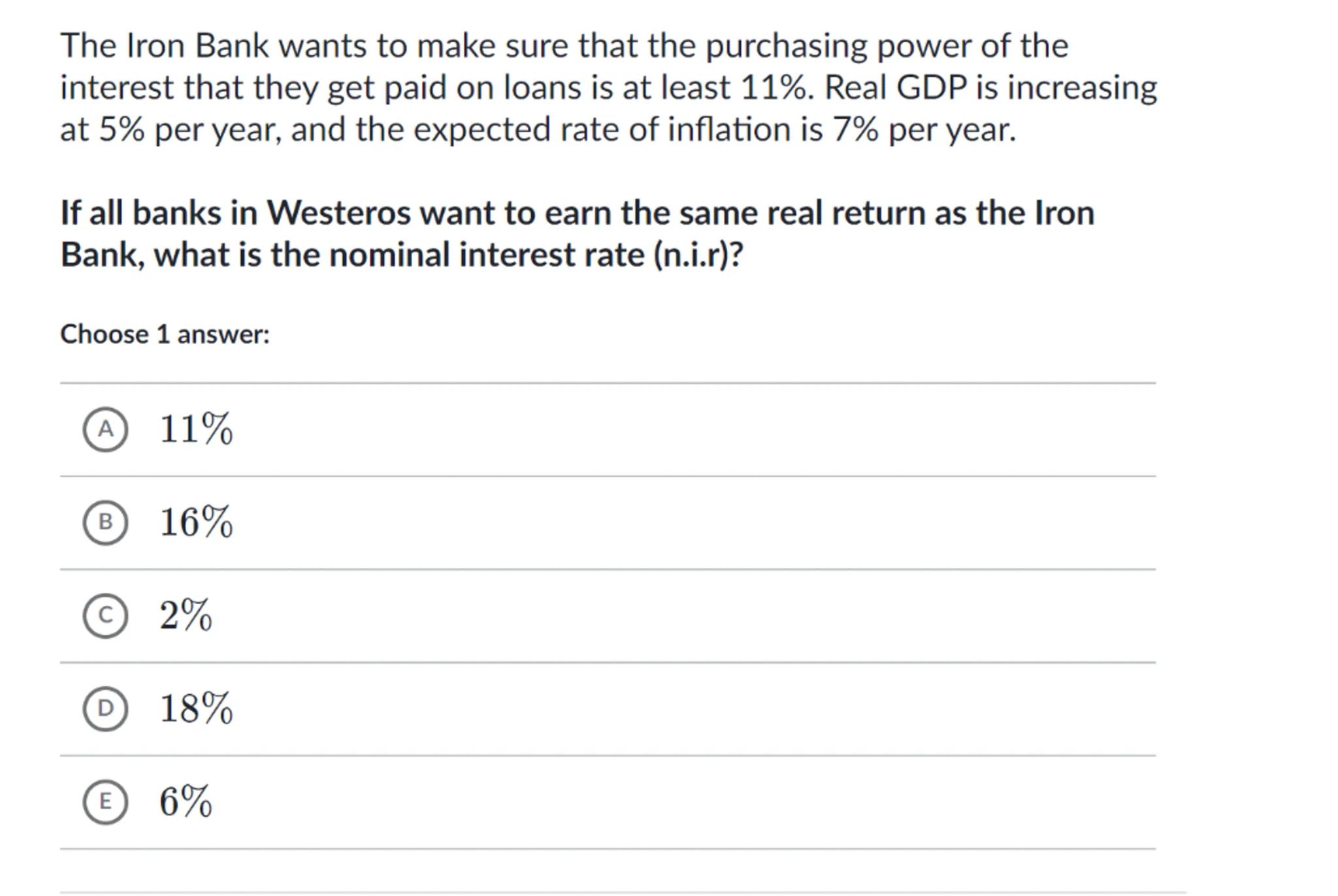

The Iron Bank wants to make sure that the purchasing power of the interest that they get paid on loans is at least . Real GDP is increasing at per year, and the expected rate of inflation is per year.

If all banks in Westeros want to earn the same real return as the Iron Bank, what is the nominal interest rate (n.i.r)?

Choose 1 answer:

(A)

(B)

(c)

(D)

(E)

Answer from Sia

Posted almost 2 years ago

Solution by Steps

step 1

To calculate the nominal interest rate (n.i.r), we use the Fisher equation, which relates the real interest rate (r), the nominal interest rate (i), and the inflation rate (π):

step 2

Given that the real interest rate the Iron Bank wants to ensure is and the expected inflation rate is , we substitute these values into the Fisher equation:

step 3

Adding the real interest rate and the inflation rate:

∻Answer∻

The nominal interest rate (n.i.r) that all banks in Westeros would need to charge to earn the same real return as the Iron Bank is

D

Key Concept

Fisher Equation

Explanation

The Fisher equation is used to calculate the nominal interest rate based on the desired real interest rate and the expected inflation rate.

Not the question you are looking for? Ask here!

Enter question by text

Enter question by image

Unlock Smarter Learning with AskSia Super!

Join Super, our all-in-one AI solution that can greatly improve your learning efficiency.

30% higher accuracy than GPT-4o

Entire learning journey support

The most student-friendly features

Study Other Question