Sia

Question

Statistics

Posted almost 2 years ago

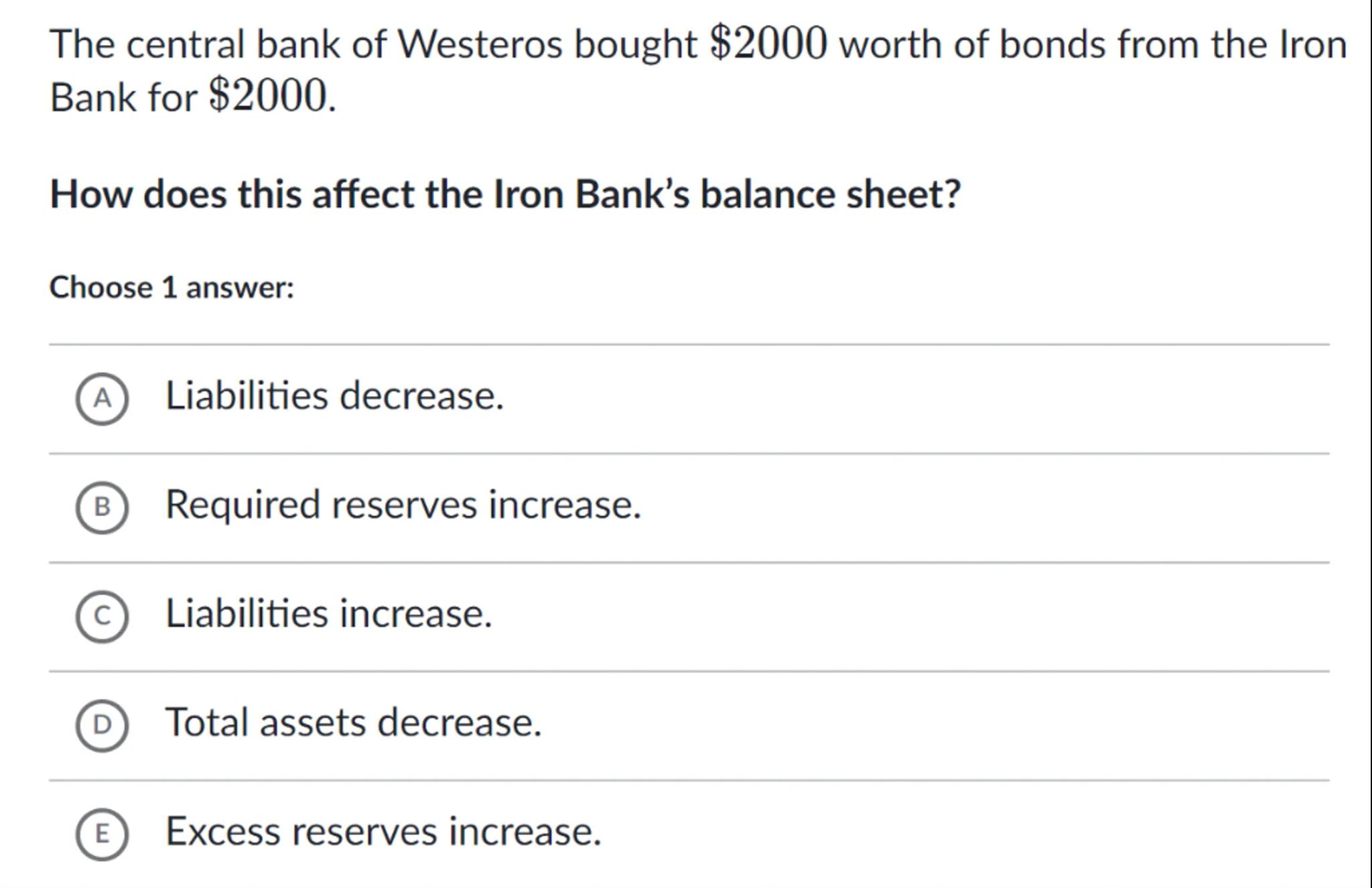

The central bank of Westeros bought worth of bonds from the Iron Bank for .

How does this affect the Iron Bank's balance sheet?

Choose 1 answer:

(A) Liabilities decrease.

(B) Required reserves increase.

(C) Liabilities increase.

(D) Total assets decrease.

(E) Excess reserves increase.

Answer from Sia

Posted almost 2 years ago

Solution by Steps

step 1

Understand the transaction: The central bank of Westeros is buying bonds from the Iron Bank for $2000. This means the Iron Bank is selling assets (bonds) and receiving cash in return

step 2

Analyze the impact on assets: When the Iron Bank sells bonds, it loses that asset, but gains cash. The overall effect on total assets is neutral, as one asset is exchanged for another of equal value

step 3

Analyze the impact on liabilities: The transaction does not involve the Iron Bank taking on any new debt or obligations, so liabilities do not increase

step 4

Consider the impact on reserves: The cash received from the central bank can be considered as reserves. Since the Iron Bank has more cash, its reserves increase. This does not necessarily mean that required reserves increase, but it does mean that excess reserves increase

Answer

E

Key Concept

Impact of bond sale on reserves

Explanation

When a bank sells bonds to the central bank, it receives cash in return, which increases its reserves. This does not affect the total assets or liabilities but increases the excess reserves.

Not the question you are looking for? Ask here!

Enter question by text

Enter question by image

Unlock Smarter Learning with AskSia Super!

Join Super, our all-in-one AI solution that can greatly improve your learning efficiency.

30% higher accuracy than GPT-4o

Entire learning journey support

The most student-friendly features

Study Other Question