Sia

Question

Statistics

Posted almost 2 years ago

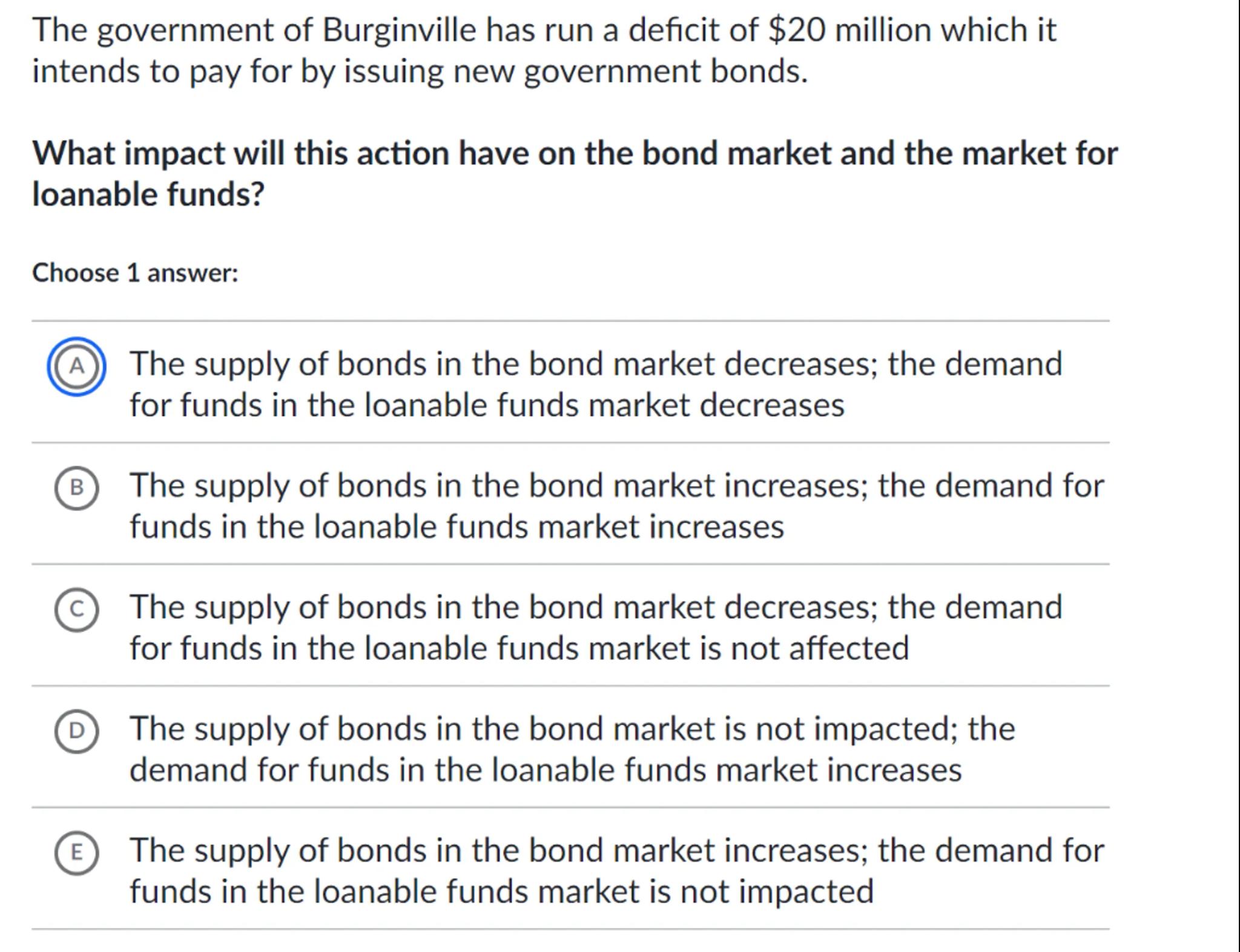

The government of Burginville has run a deficit of million which it intends to pay for by issuing new government bonds.

What impact will this action have on the bond market and the market for loanable funds?

Choose 1 answer:

(A) The supply of bonds in the bond market decreases; the demand for funds in the loanable funds market decreases

(B) The supply of bonds in the bond market increases; the demand for funds in the loanable funds market increases

(C) The supply of bonds in the bond market decreases; the demand for funds in the loanable funds market is not affected

D The supply of bonds in the bond market is not impacted; the demand for funds in the loanable funds market increases

(E) The supply of bonds in the bond market increases; the demand for funds in the loanable funds market is not impacted

Answer from Sia

Posted almost 2 years ago

Solution by Steps

step 1

To understand the impact of the government of Burgainville issuing new government bonds, we must consider the basic principles of supply and demand in financial markets

step 2

Issuing new government bonds to pay for a deficit increases the supply of bonds in the bond market because the government is adding more bonds to the market

step 3

The government needs to borrow funds to finance the deficit, which increases the demand for loanable funds in the financial market, as the government is now competing for funds with other borrowers

step 4

Since the government is issuing bonds to raise money, it does not affect the demand for loanable funds directly; instead, it affects the supply of loanable funds by borrowers who are now purchasing the bonds

step 5

The correct answer must reflect an increase in the supply of bonds due to the new issuance and no direct impact on the demand for loanable funds, as the government is the issuer, not a direct competitor for existing funds

Answer

E

Key Concept

The relationship between bond issuance and the markets for bonds and loanable funds

Explanation

When a government issues new bonds, it increases the supply of bonds in the bond market. This action does not directly increase the demand for loanable funds, as the government is not demanding funds but rather supplying bonds.

Not the question you are looking for? Ask here!

Enter question by text

Enter question by image

Unlock Smarter Learning with AskSia Super!

Join Super, our all-in-one AI solution that can greatly improve your learning efficiency.

30% higher accuracy than GPT-4o

Entire learning journey support

The most student-friendly features

Study Other Question