Sia

Question

Statistics

Posted almost 2 years ago

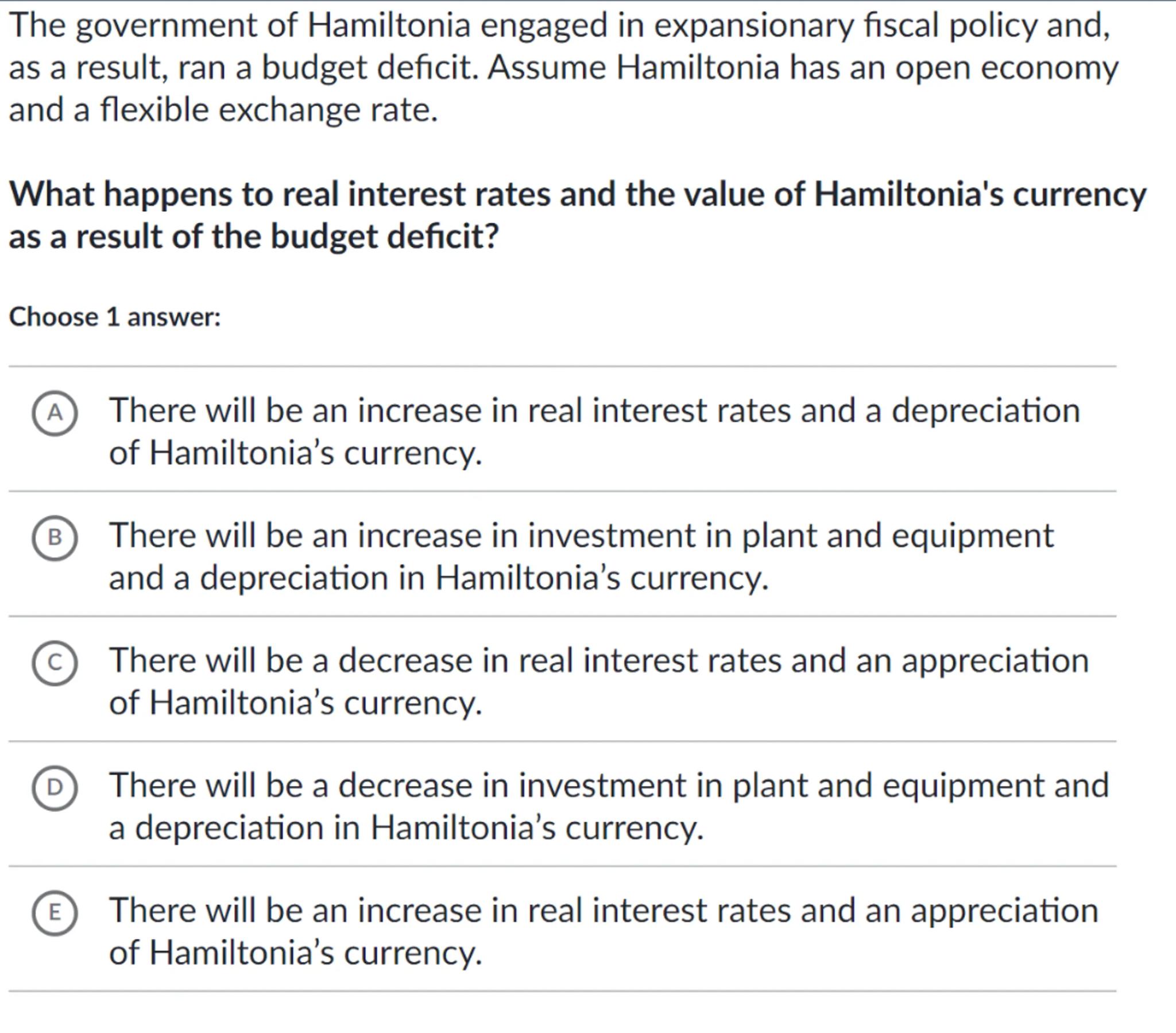

The government of Hamiltonia engaged in expansionary fiscal policy and, as a result, ran a budget deficit. Assume Hamiltonia has an open economy and a flexible exchange rate.

What happens to real interest rates and the value of Hamiltonia's currency as a result of the budget deficit?

Choose 1 answer:

(A) There will be an increase in real interest rates and a depreciation of Hamiltonia's currency.

(B) There will be an increase in investment in plant and equipment and a depreciation in Hamiltonia's currency.

(c) There will be a decrease in real interest rates and an appreciation of Hamiltonia's currency.

(D) There will be a decrease in investment in plant and equipment and a depreciation in Hamiltonia's currency.

(E) There will be an increase in real interest rates and an appreciation of Hamiltonia's currency.

Answer from Sia

Posted almost 2 years ago

Solution by Steps

step 1

To analyze the impact of a budget deficit on real interest rates and the currency value, we consider the loanable funds market and the foreign exchange market

step 2

In the loanable funds market, a government budget deficit means the government is borrowing more, which increases the demand for loanable funds

step 3

According to the supply and demand model, an increase in demand for loanable funds leads to an increase in the real interest rate

step 4

In the foreign exchange market, higher real interest rates attract foreign capital, increasing the demand for Hamiltonia's currency

step 5

Increased demand for the currency should lead to an appreciation of the currency. However, the expansionary fiscal policy can also lead to a higher inflation rate, which could potentially depreciate the currency

step 6

The net effect on the currency value depends on the relative strength of these two effects, but traditionally, the interest rate effect dominates in the short run, leading to currency appreciation

Answer

The correct answer is (E) There will be an increase in real interest rates and an appreciation of Hamiltonia's currency.

E

Key Concept

Loanable Funds Market and Foreign Exchange Market

Explanation

A budget deficit increases the demand for loanable funds, raising real interest rates. Higher interest rates attract foreign capital, leading to currency appreciation.

Not the question you are looking for? Ask here!

Enter question by text

Enter question by image

Unlock Smarter Learning with AskSia Super!

Join Super, our all-in-one AI solution that can greatly improve your learning efficiency.

30% higher accuracy than GPT-4o

Entire learning journey support

The most student-friendly features

Study Other Question