Sia

Question

Microeconomics

Posted almost 2 years ago

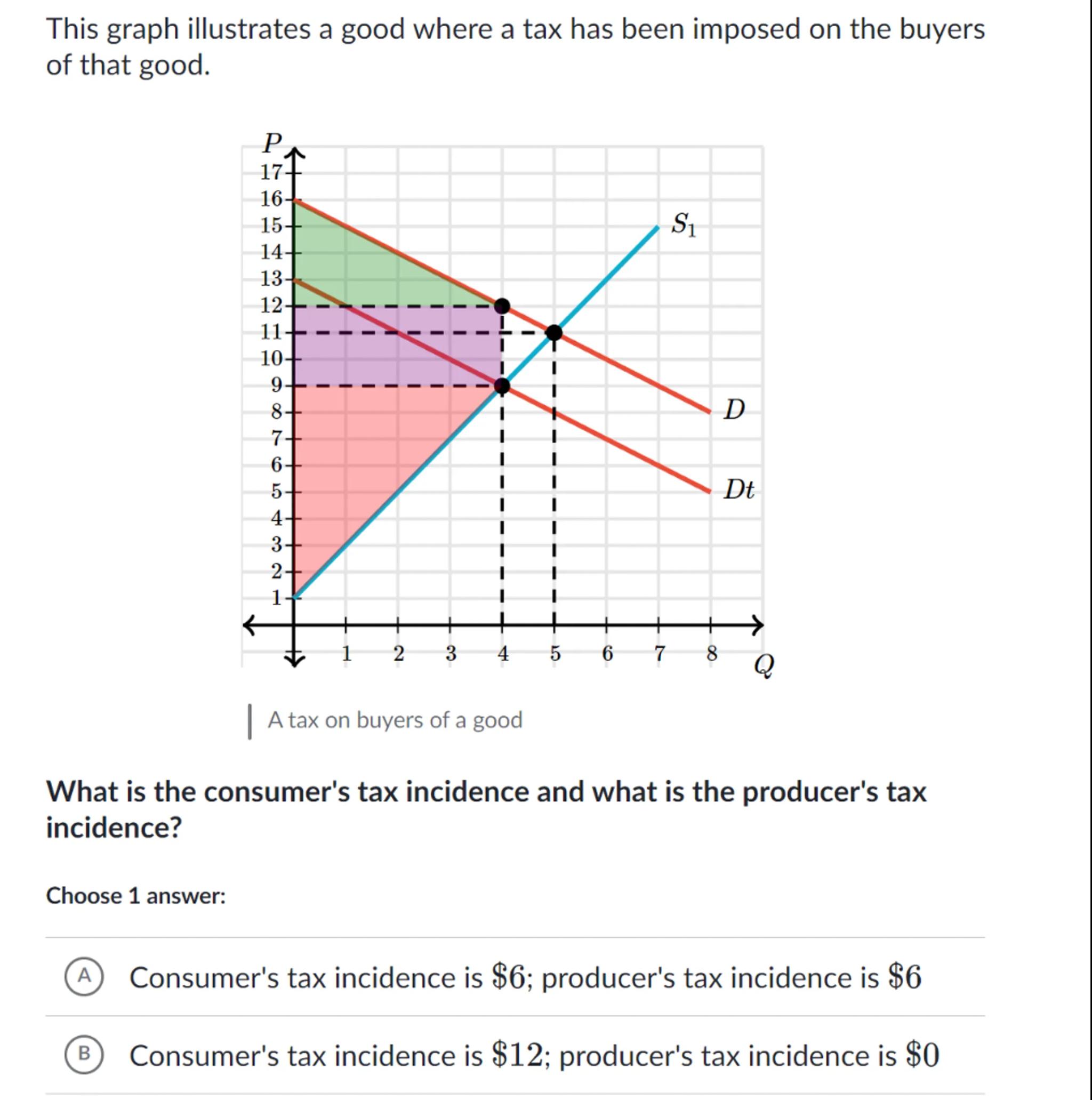

This graph illustrates a good where a tax has been imposed on the buyers of that good.

A tax on buyers of a good

What is the consumer's tax incidence and what is the producer's tax incidence?

Choose 1 answer:

(A) Consumer's tax incidence is ; producer's tax incidence is

(B) Consumer's tax incidence is ; producer's tax incidence is

Answer from Sia

Posted almost 2 years ago

Solution

a

Consumer's Tax Incidence: The consumer's tax incidence is the difference between the price consumers pay after the tax () and the price they paid before the tax (). From the graph, and . Therefore, the consumer's tax incidence is

b

Producer's Tax Incidence: The producer's tax incidence is the difference between the price producers receive before the tax () and the price they receive after the tax (). From the graph, and . Therefore, the producer's tax incidence is

Answer

Consumer's tax incidence is 1

Key Concept

Tax Incidence

Explanation

Tax incidence refers to the distribution of the tax burden between consumers and producers. In this case, both consumers and producers share the tax burden equally, each bearing $1 of the tax.

Not the question you are looking for? Ask here!

Enter question by text

Enter question by image

Unlock Smarter Learning with AskSia Super!

Join Super, our all-in-one AI solution that can greatly improve your learning efficiency.

30% higher accuracy than GPT-4o

Entire learning journey support

The most student-friendly features

Study Other Question