Sia

Question

Microeconomics

Posted almost 2 years ago

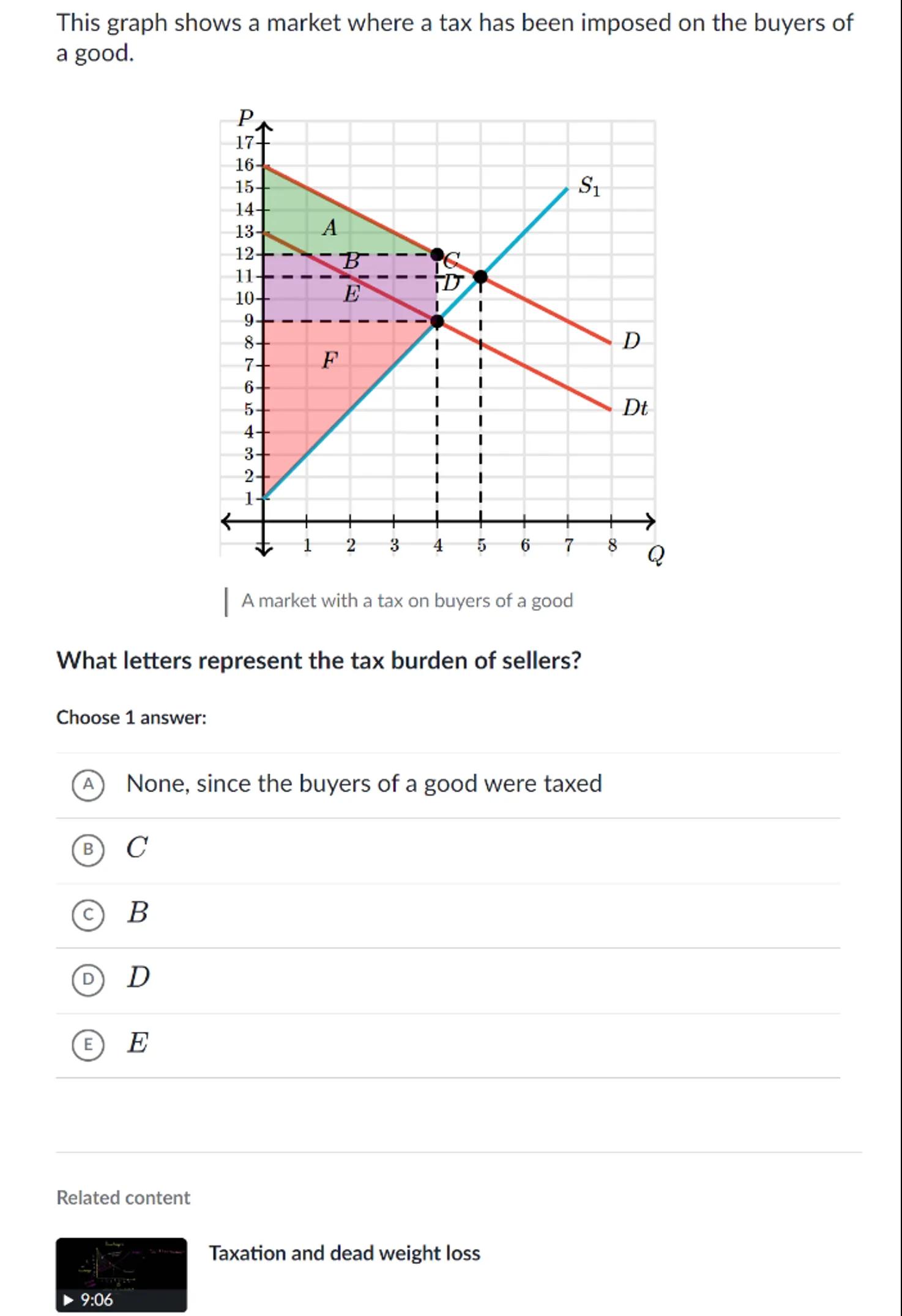

This graph shows a market where a tax has been imposed on the buyers of a good.

A market with a tax on buyers of a good

What letters represent the tax burden of sellers?

Choose 1 answer:

(A) None, since the buyers of a good were taxed

(B)

(C)

(D)

(E)

Related content

Taxation and dead weight loss

Answer from Sia

Posted almost 2 years ago

Solution

a

Tax Incidence: When a tax is imposed on buyers, the demand curve shifts downward by the amount of the tax. This results in a new equilibrium where both buyers and sellers share the tax burden

b

Identifying Tax Burden: The tax burden on sellers is represented by the area between the original supply curve (S1) and the new equilibrium price after the tax is imposed. In this graph, this area is labeled as

Answer

(B)

Key Concept

Tax Incidence

Explanation

When a tax is imposed on buyers, the demand curve shifts downward, and the tax burden is shared between buyers and sellers. The area representing the tax burden on sellers is labeled in the graph.

Not the question you are looking for? Ask here!

Enter question by text

Enter question by image

Unlock Smarter Learning with AskSia Super!

Join Super, our all-in-one AI solution that can greatly improve your learning efficiency.

30% higher accuracy than GPT-4o

Entire learning journey support

The most student-friendly features

Study Other Question