Sia

Question

Microeconomics

Posted almost 2 years ago

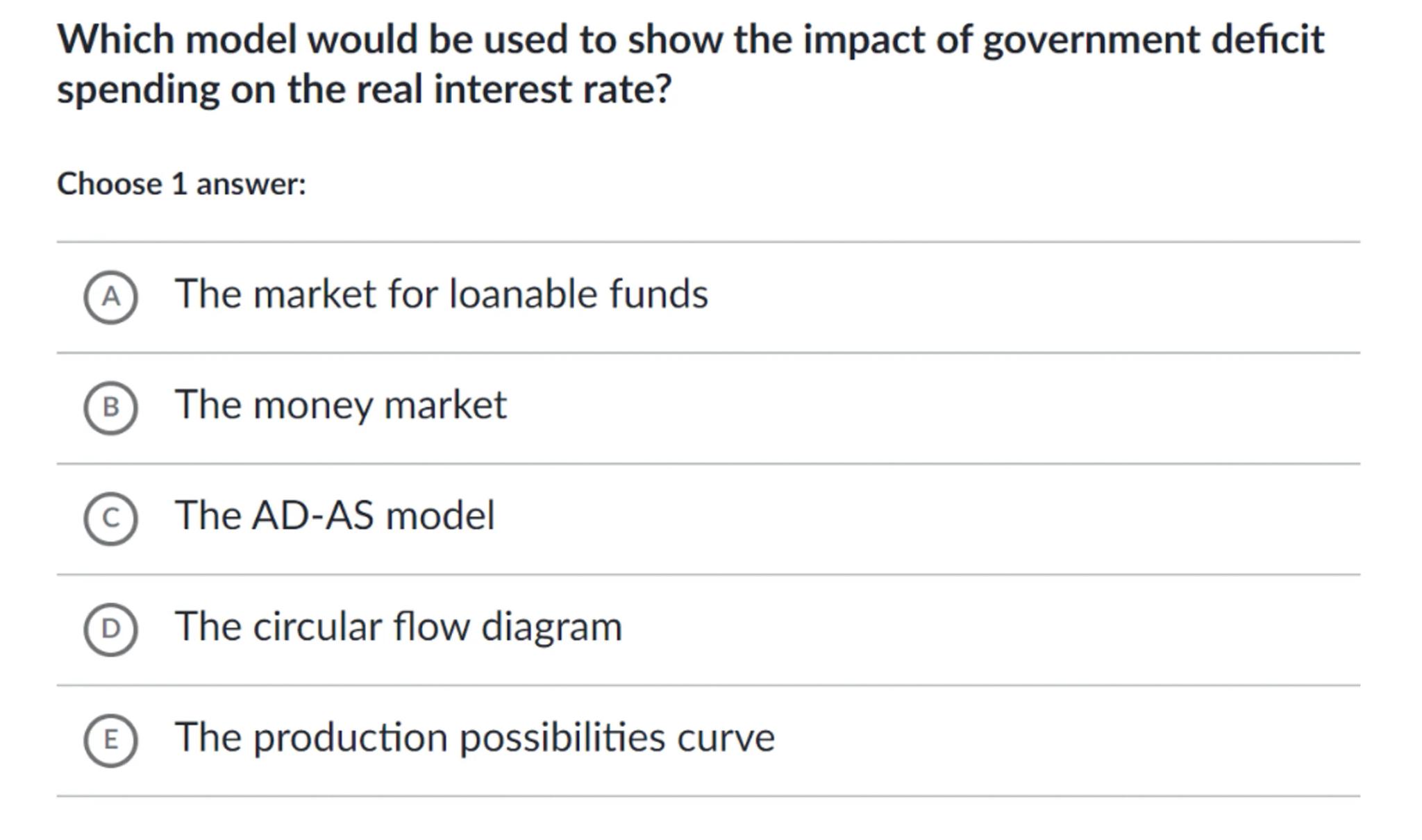

Which model would be used to show the impact of government deficit spending on the real interest rate?

Choose 1 answer:

(A) The market for loanable funds

(B) The money market

(C) The AD-AS model

D The circular flow diagram

(E) The production possibilities curve

Answer from Sia

Posted almost 2 years ago

Solution

a

The market for loanable funds: This model illustrates the interaction between borrowers and lenders, determining the equilibrium interest rate based on the supply and demand for loanable funds

b

Government deficit spending: When the government borrows to finance its deficit, it increases the demand for loanable funds. This shift in demand can lead to a higher equilibrium interest rate

c

Real interest rate: The real interest rate is the nominal interest rate adjusted for inflation. An increase in government borrowing can raise the nominal interest rate, which, if inflation expectations remain constant, also increases the real interest rate

Answer

(A) The market for loanable funds

Key Concept

The market for loanable funds

Explanation

The market for loanable funds is used to show the impact of government deficit spending on the real interest rate because it directly illustrates how increased government borrowing affects the supply and demand for loanable funds, leading to changes in the equilibrium interest rate.

Not the question you are looking for? Ask here!

Enter question by text

Enter question by image

Unlock Smarter Learning with AskSia Super!

Join Super, our all-in-one AI solution that can greatly improve your learning efficiency.

30% higher accuracy than GPT-4o

Entire learning journey support

The most student-friendly features

Study Other Question