Sia

Question

Microeconomics

Posted almost 2 years ago

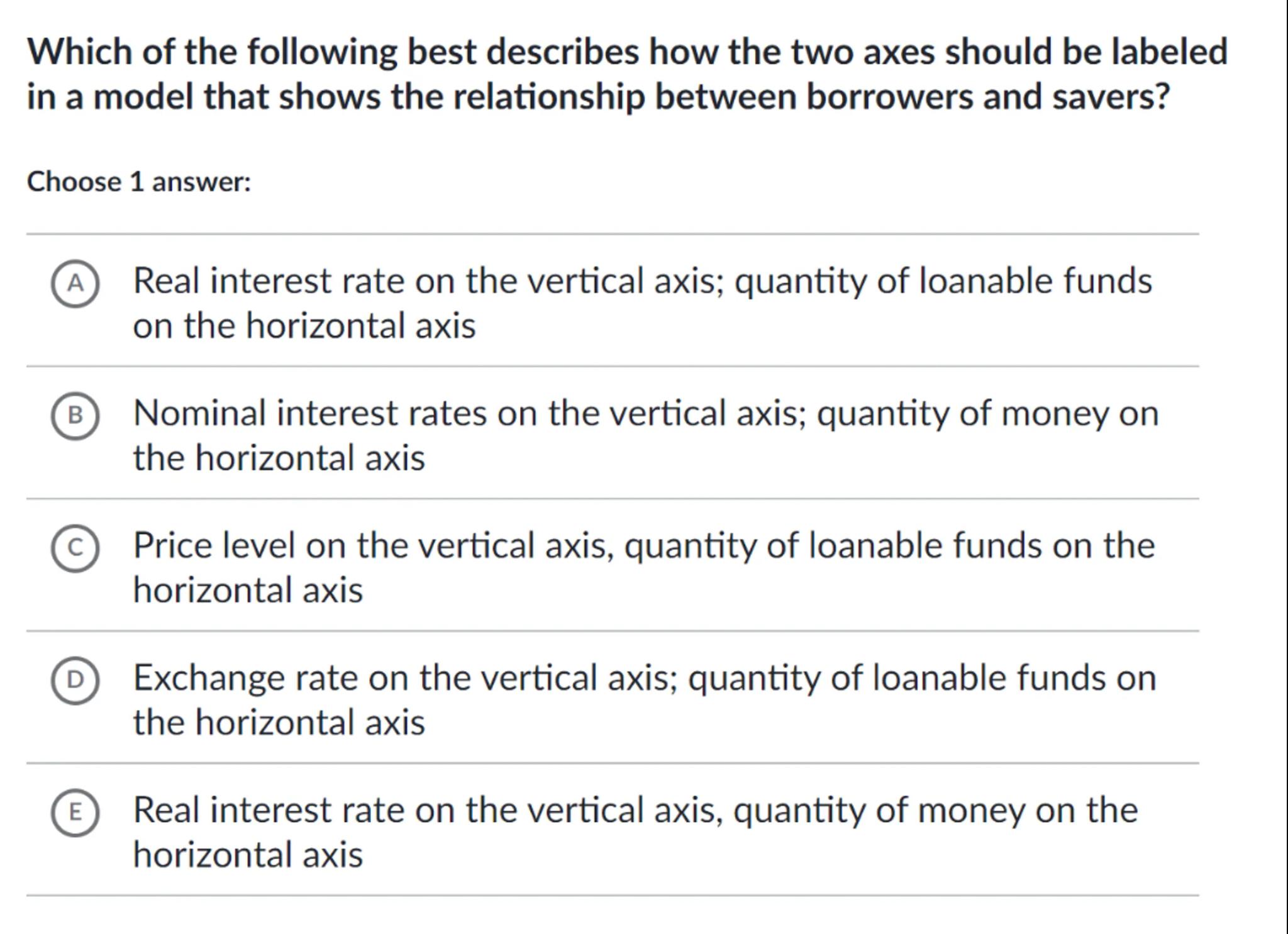

Which of the following best describes how the two axes should be labeled in a model that shows the relationship between borrowers and savers?

Choose 1 answer:

(A) Real interest rate on the vertical axis; quantity of loanable funds on the horizontal axis

(B) Nominal interest rates on the vertical axis; quantity of money on the horizontal axis

(c) Price level on the vertical axis, quantity of loanable funds on the horizontal axis

(D) Exchange rate on the vertical axis; quantity of loanable funds on the horizontal axis

(E) Real interest rate on the vertical axis, quantity of money on the horizontal axis

Answer from Sia

Posted almost 2 years ago

Solution

a

Real Interest Rate: The real interest rate is the interest rate adjusted for inflation, reflecting the true cost of borrowing and the true return on savings

b

Quantity of Loanable Funds: This represents the total amount of funds available for borrowing in the financial market

c

Correct Labeling: In a model showing the relationship between borrowers and savers, the vertical axis should represent the real interest rate, and the horizontal axis should represent the quantity of loanable funds

Answer

(A) Real interest rate on the vertical axis; quantity of loanable funds on the horizontal axis

Key Concept

The relationship between borrowers and savers is best represented by the real interest rate and the quantity of loanable funds.

Explanation

The real interest rate reflects the true cost of borrowing and the true return on savings, while the quantity of loanable funds represents the total funds available for borrowing. This combination accurately captures the dynamics between borrowers and savers.

Not the question you are looking for? Ask here!

Enter question by text

Enter question by image

Unlock Smarter Learning with AskSia Super!

Join Super, our all-in-one AI solution that can greatly improve your learning efficiency.

30% higher accuracy than GPT-4o

Entire learning journey support

The most student-friendly features

Study Other Question