Sia

Question

Statistics

Posted almost 2 years ago

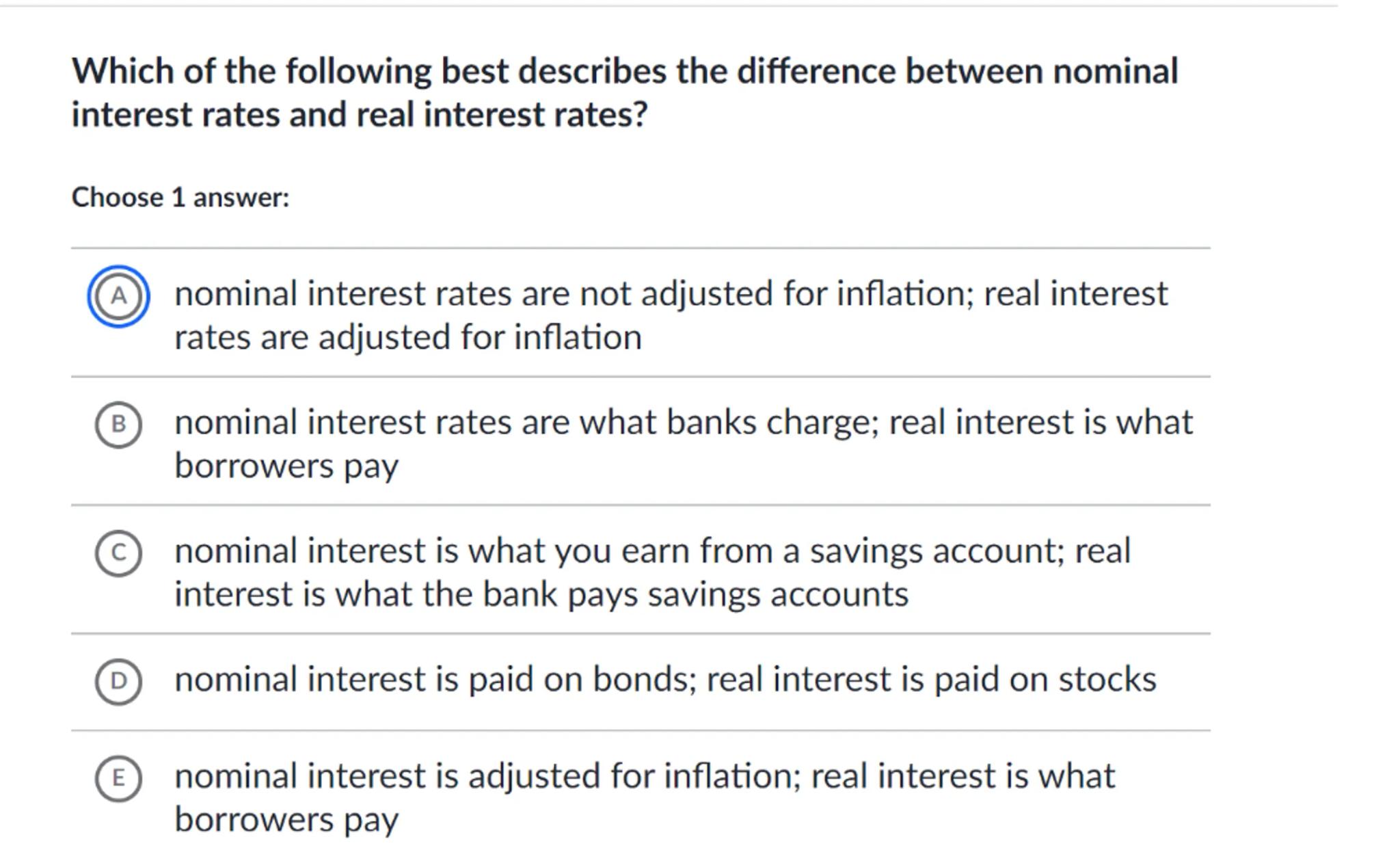

Which of the following best describes the difference between nominal interest rates and real interest rates?

Choose 1 answer:

(A) nominal interest rates are not adjusted for inflation; real interest rates are adjusted for inflation

(B) nominal interest rates are what banks charge; real interest is what borrowers pay

(c) nominal interest is what you earn from a savings account; real interest is what the bank pays savings accounts

(D) nominal interest is paid on bonds; real interest is paid on stocks

(E) nominal interest is adjusted for inflation; real interest is what borrowers pay

Answer from Sia

Posted almost 2 years ago

Solution by Steps

step 1

Understand the definitions of nominal and real interest rates. Nominal interest rates are the rates quoted by financial institutions, not adjusted for inflation. Real interest rates are nominal rates adjusted for the effect of inflation

step 2

Evaluate the given options in the context of the definitions from step 1

step 3

Identify the correct option that matches the definitions

Answer

A

Key Concept

Nominal vs. Real Interest Rates

Explanation

Nominal interest rates are the stated rates before taking inflation into account, while real interest rates are nominal rates adjusted for inflation.

Not the question you are looking for? Ask here!

Enter question by text

Enter question by image

Unlock Smarter Learning with AskSia Super!

Join Super, our all-in-one AI solution that can greatly improve your learning efficiency.

30% higher accuracy than GPT-4o

Entire learning journey support

The most student-friendly features

Study Other Question