Sia

Question

Microeconomics

Posted almost 2 years ago

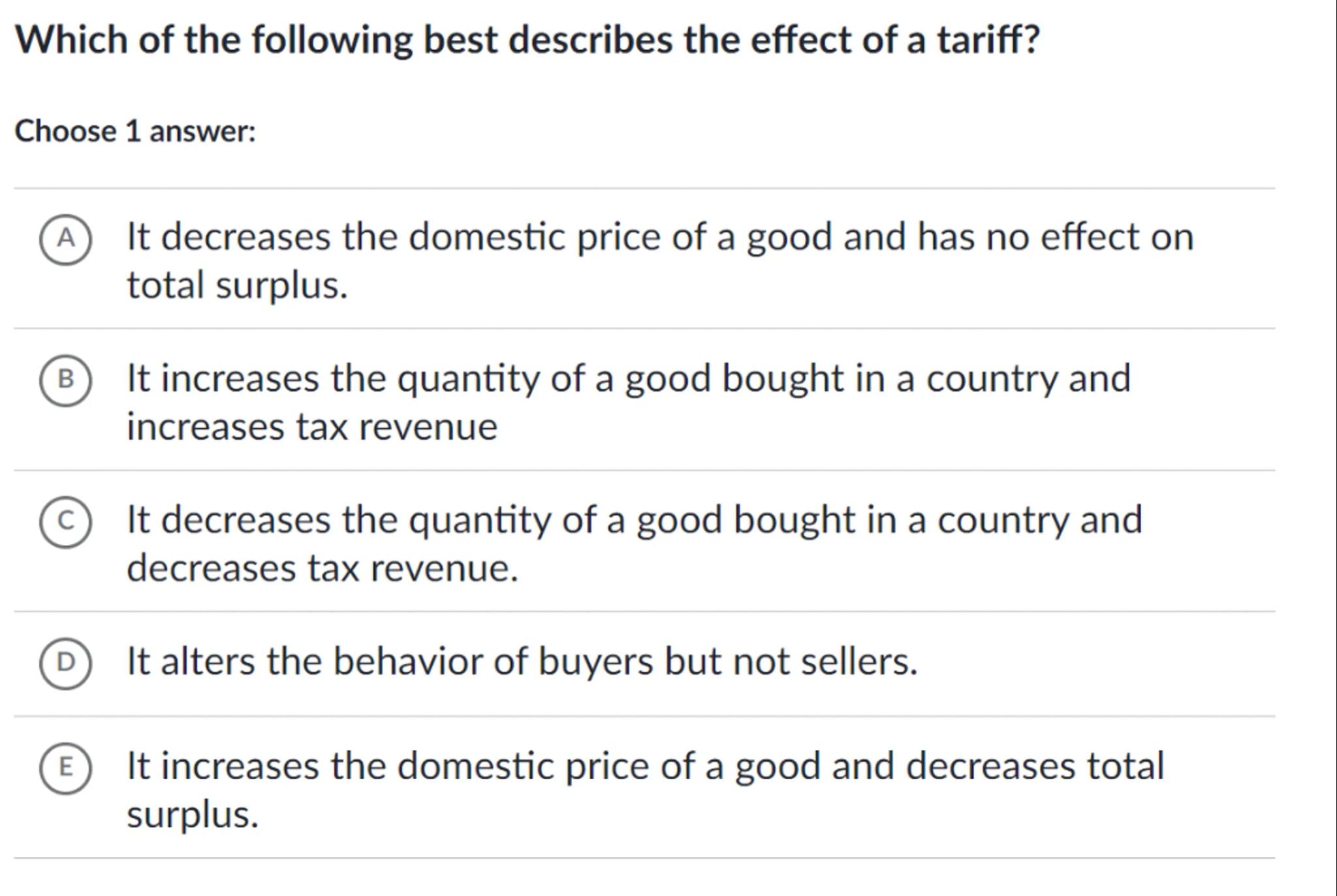

Which of the following best describes the effect of a tariff?

Choose 1 answer:

A It decreases the domestic price of a good and has no effect on total surplus.

B) It increases the quantity of a good bought in a country and increases tax revenue

(c) It decreases the quantity of a good bought in a country and decreases tax revenue.

D) It alters the behavior of buyers but not sellers.

(E) It increases the domestic price of a good and decreases total surplus.

Answer from Sia

Posted almost 2 years ago

Solution

a

Tariff Definition: A tariff is a tax imposed on imported goods, which typically increases the price of the imported goods in the domestic market

b

Effect on Domestic Price: The imposition of a tariff increases the domestic price of the good because the tax is added to the cost of the imported goods

c

Effect on Quantity Bought: Higher prices due to the tariff generally lead to a decrease in the quantity of the good bought in the country

d

Effect on Total Surplus: The increase in price and decrease in quantity bought result in a loss of consumer and producer surplus, leading to a decrease in total surplus

Answer

(E) It increases the domestic price of a good and decreases total surplus.

Key Concept

Tariff Effects

Explanation

A tariff increases the domestic price of imported goods, reduces the quantity bought, and decreases total surplus due to the loss in consumer and producer surplus.

Not the question you are looking for? Ask here!

Enter question by text

Enter question by image

Unlock Smarter Learning with AskSia Super!

Join Super, our all-in-one AI solution that can greatly improve your learning efficiency.

30% higher accuracy than GPT-4o

Entire learning journey support

The most student-friendly features

Study Other Question