Sia

Question

Statistics

Posted almost 2 years ago

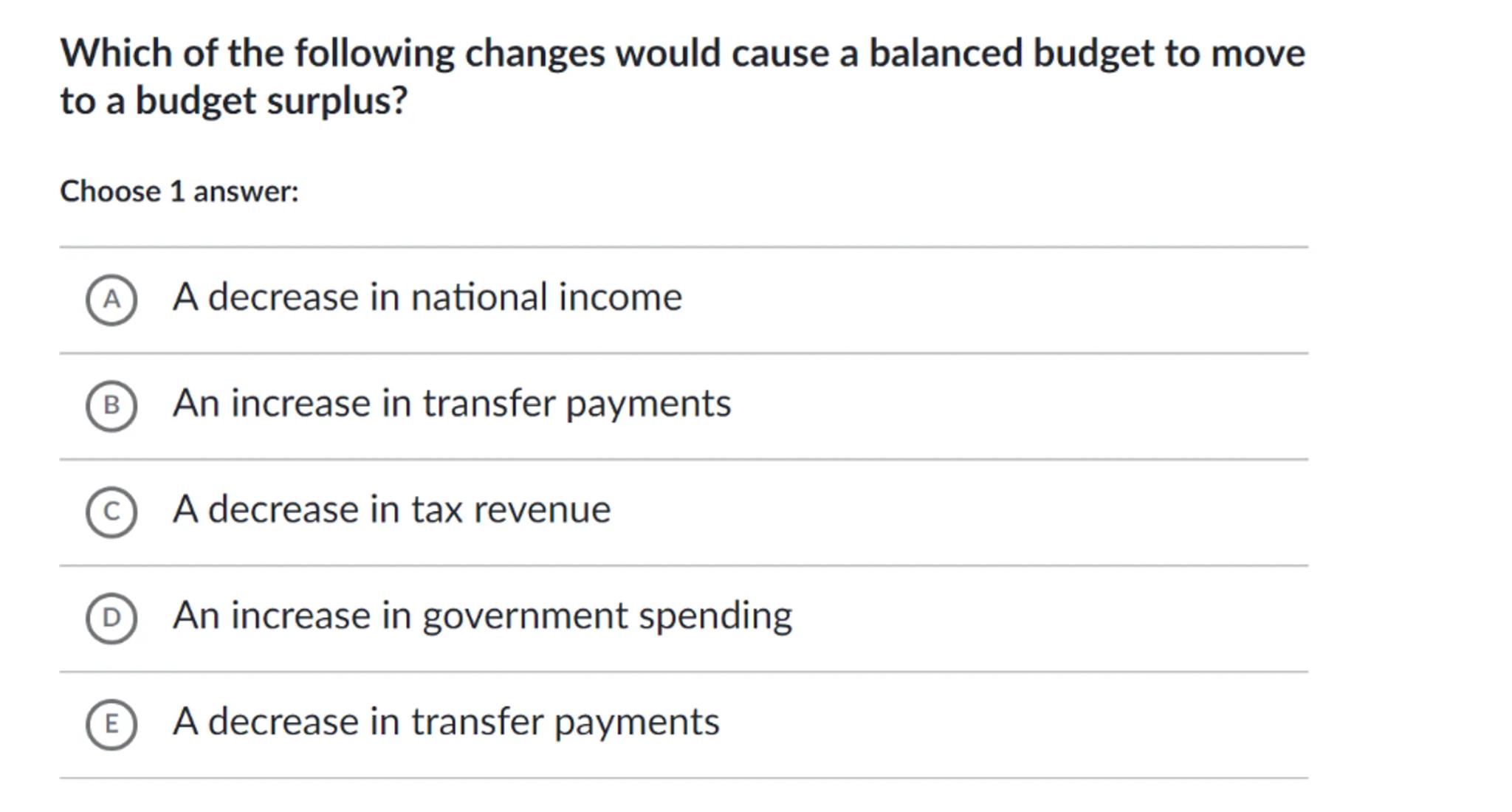

Which of the following changes would cause a balanced budget to move to a budget surplus?

Choose 1 answer:

(A) A decrease in national income

(B) An increase in transfer payments

(C) A decrease in tax revenue

(D) An increase in government spending

(E) A decrease in transfer payments

Answer from Sia

Posted almost 2 years ago

Solution by Steps

step 1

Identify the impact of each option on a balanced budget: A balanced budget occurs when government spending equals tax revenue. To move to a budget surplus, government spending must decrease, or tax revenue must increase

step 2

Analyze the options: Option A (A decrease in national income) would likely decrease tax revenue, not create a surplus. Option B (An increase in transfer payments) would increase government spending. Option C (A decrease in tax revenue) would move the budget towards a deficit. Option D (An increase in government spending) also moves towards a deficit. Option E (A decrease in transfer payments) would decrease government spending, which could create a surplus if tax revenue remains constant

∻Answer∻

The correct answer is the one that would lead to a decrease in government spending without reducing tax revenue, thus creating a surplus

E

Key Concept

Budget Surplus

Explanation

A budget surplus occurs when government spending is less than tax revenue; decreasing transfer payments reduces government spending without affecting tax revenue.

Not the question you are looking for? Ask here!

Enter question by text

Enter question by image

Unlock Smarter Learning with AskSia Super!

Join Super, our all-in-one AI solution that can greatly improve your learning efficiency.

30% higher accuracy than GPT-4o

Entire learning journey support

The most student-friendly features

Study Other Question