Sia

Question

Statistics

Posted almost 2 years ago

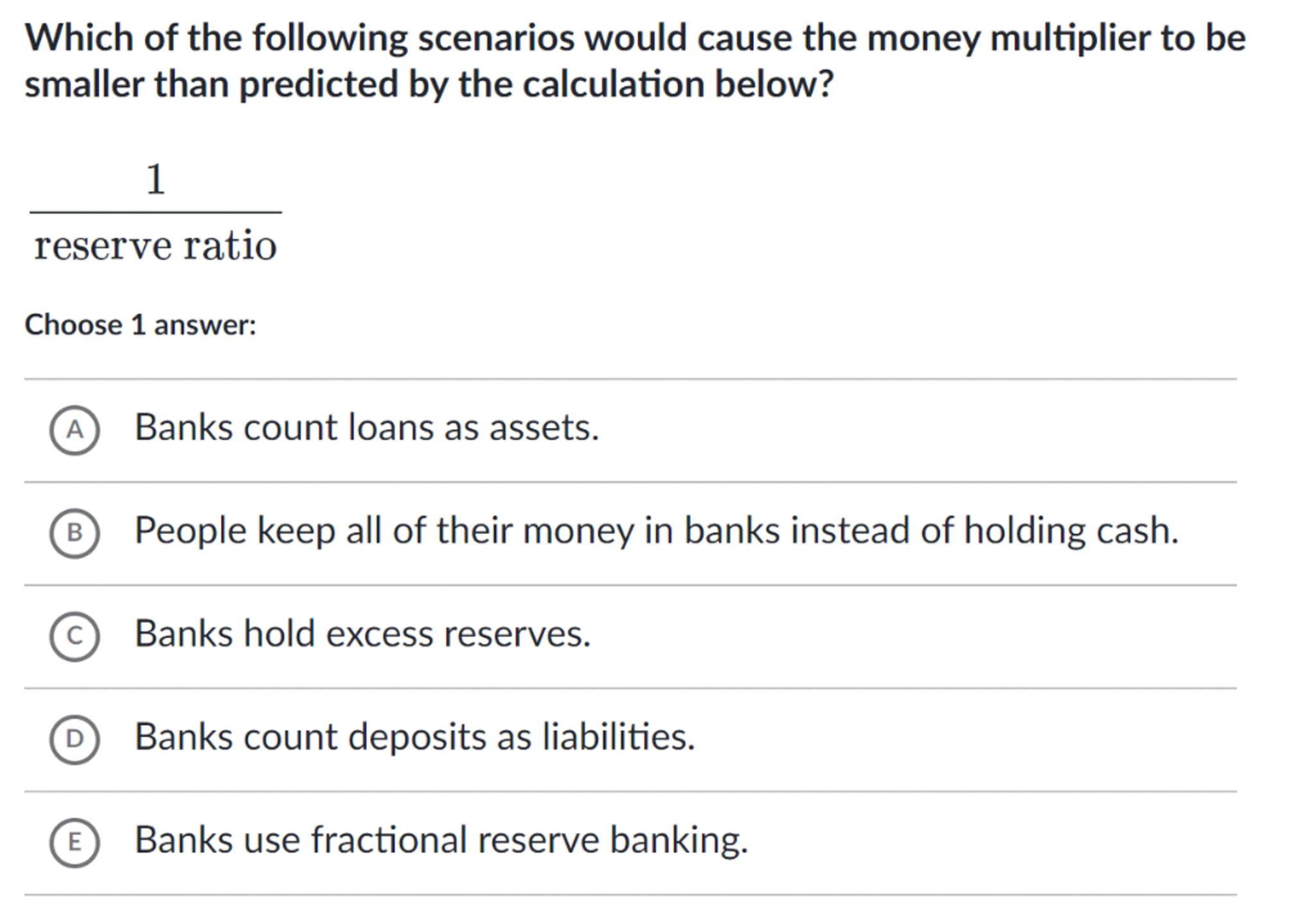

Which of the following scenarios would cause the money multiplier to be smaller than predicted by the calculation below?

Choose 1 answer:

(A) Banks count loans as assets.

(B) People keep all of their money in banks instead of holding cash.

(C) Banks hold excess reserves.

(D) Banks count deposits as liabilities.

(E) Banks use fractional reserve banking.

Answer from Sia

Posted almost 2 years ago

Solution by Steps

step 1

The money multiplier is calculated as

step 2

The money multiplier can be smaller than predicted if banks hold excess reserves. This is because holding excess reserves reduces the amount of money available for lending, thus reducing the overall money supply

step 3

Therefore, the scenario where banks hold excess reserves would cause the money multiplier to be smaller than predicted

C

Key Concept

Money Multiplier

Explanation

The money multiplier is the ratio of the amount of money in the economy to the amount of reserves in the banking system. If banks hold excess reserves, they lend out less money, which reduces the money multiplier.

Not the question you are looking for? Ask here!

Enter question by text

Enter question by image

Unlock Smarter Learning with AskSia Super!

Join Super, our all-in-one AI solution that can greatly improve your learning efficiency.

30% higher accuracy than GPT-4o

Entire learning journey support

The most student-friendly features

Study Other Question