Sia

Question

Statistics

Posted almost 2 years ago

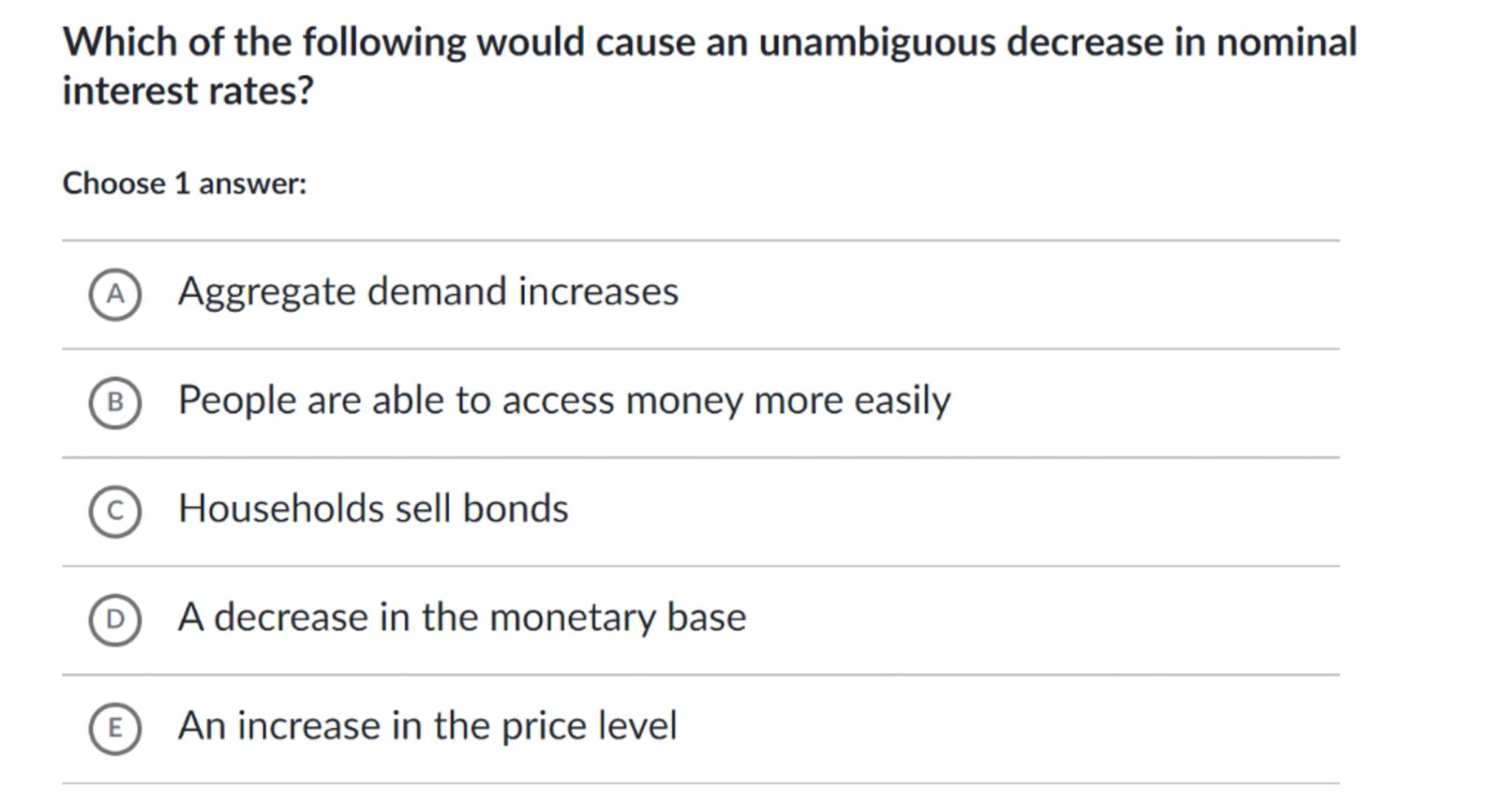

Which of the following would cause an unambiguous decrease in nominal interest rates?

Choose 1 answer:

(A) Aggregate demand increases

(B) People are able to access money more easily

(c) Households sell bonds

(D) A decrease in the monetary base

(E) An increase in the price level

Answer from Sia

Posted almost 2 years ago

Solution by Steps

step 1

To determine the effect on nominal interest rates, we must understand the relationship between the supply and demand for money

step 2

An increase in aggregate demand (A) typically leads to higher prices and potentially higher interest rates, not a decrease

step 3

If people can access money more easily (B), this implies an increase in the money supply, which can lead to lower nominal interest rates

step 4

Households selling bonds (C) would increase the supply of bonds and decrease their price, leading to higher interest rates

step 5

A decrease in the monetary base (D) would lead to a decrease in the money supply, which would typically increase interest rates

step 6

An increase in the price level (E) is associated with inflation, which often leads to higher nominal interest rates

step 7

The only option that unambiguously leads to a decrease in nominal interest rates is when the money supply increases, making money more accessible (B)

Answer

B

Key Concept

Money Supply and Interest Rates

Explanation

An increase in the money supply, assuming demand remains constant, typically leads to lower nominal interest rates.

Not the question you are looking for? Ask here!

Enter question by text

Enter question by image

Unlock Smarter Learning with AskSia Super!

Join Super, our all-in-one AI solution that can greatly improve your learning efficiency.

30% higher accuracy than GPT-4o

Entire learning journey support

The most student-friendly features

Study Other Question